The Speaker is the smartest man in energy we know. Looking at oil supply and demand balances, he sees an inflection in the oil market by July, when oil balances will flip into deficit.

While oil demand has fallen by 8.6 million bpd to 91.2 million bpd due to the pandemic, oil supply should fall by 12 million bpd to a nine-year low of 88 million bpd, as OPEC+ agreed to curb production and shale producers turn off rigs at a record pace.

“Physical oil differentials point to a sharp positive inflection,” he said. US oil grades differentials are trading back at February levels, and the Dubai crude curve and dated Brent differentials are now firming significantly with Dubai front-month now in backwardation.

The Speaker has been calling for Brent to hit $45 by late summer. He does not expect more upside as inventories will remain elevated.

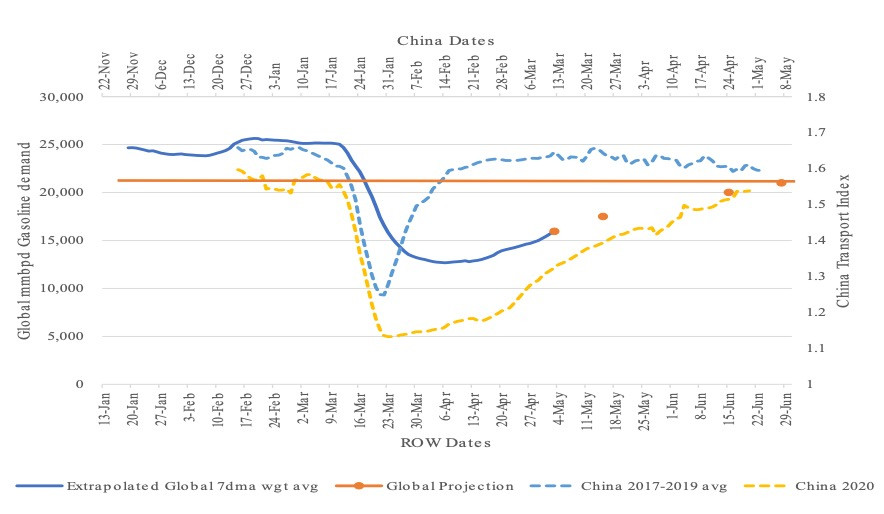

He thinks there is a misplaced view about oil demand “being destroyed” over time by electric vehicles. There are 5.5 million electric vehicles compared with a global fleet of 1.3 billion gasoline or diesel-powered autos. “China’s recovery path from the pandemic indicates that global driving could be close to normal by mid-July.”

Source: Bloomberg

The big question is how much oil production from US shale fields will plummet. More than 55 percent of shale output is from wells drilled in the past 14 months. Since mid-March, operators have idled almost two-thirds of US rigs and drilling activity has touched an all-time low.

The Permian Basin continues to be a frontrunner in basin declines. In 2021, the Permian is expected to have no growth and the Bakken and Eagle Ford shale plays are forecast to have the largest production falls. Oil service costs have to fall substantially to incentivize drilling at sub-$40 oil and kick off another production upcycle.

A survey from the Kansas City Fed found nearly one-third of the oil and oil services companies in America would face insolvency if oil stays below $40 a barrel. That’s why there is great urgency in the Trump administration to prop up oil prices. High yield spreads for energy companies have blown out to levels that are higher than those in 2016 by 72 percent despite similar oil prices. In the third quarter of 2019, 91 percent of defaulted US corporate debt was due to oil and gas companies, according to Moody’s.

Oil and gas companies worldwide have raised $171 billion in debt markets since March, equivalent to the volume of bonds sold for the industry in the whole year of 2019. That should help them manage through this crisis. The Speaker expects more sector consolidation. It was agreed that government support would be made available if conditions worsen.

Photo: Shutterstock