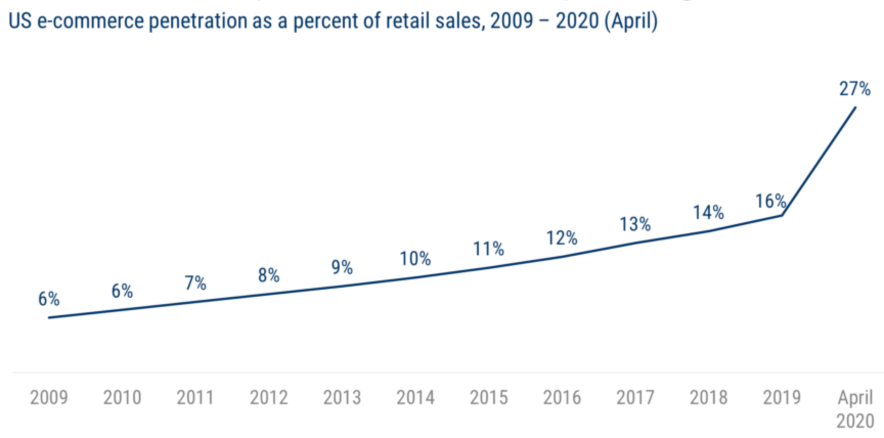

It took a decade for US ecommerce as a percentage of retail sales to rise from 6 percent to 16 percent in 2019. A few months into the pandemic, 27 percent of shopping now happens online. Ecommerce companies skipped ahead a few years and have seen their shares rocket higher.

“The world got pulled into something like 2027,” said Gavin Baker, CIO of Atreides Management in Boston. But he doesn’t see any change in the total addressable market (TAM) for any ecommerce, cloud or SaaS company. It’s just that they will get there faster. Global GDP is the ultimate rate limiting factor for TAM.

Looking at valuations, a lot of this displacement may already be priced in so he’s looking elsewhere for opportunities. For the first time in his career, Baker does not own Facebook, Amazon, Netflix or Google.

Source: CB Insights

Counter to conventional wisdom, he believes the companies that are most attractive are the leading bricks and mortar retailers that were seemingly hurtling towards bankruptcy. Not only are they going to come out of the pandemic stronger online, but they’re going to face a weaker set of bricks and mortar competitors.

“Their destinies have changed forever,” said Baker. “Bricks and mortar retailers now finally have the confidence to aggressively invest in ecommerce.” Traditional retailers which reinvent can rescue themselves and outlive competitors who fail to transform their businesses for an omnichannel future.

“There is no large ecommerce company in the world who believes in ecommerce only. They all believe in omnichannel,” he noted. Amazon will open more stores in the US this year than anyone else. JD and Alibaba are opening more stores in China than anyone else. “Not a single ecommerce company thinks physical stores don’t have value.”

Bricks and mortar stores lower customer acquisition costs and increase online advertising efficiency for ecommerce companies, even if the stores themselves don’t make money. They can be used as showrooms to experience products, warehousing and fulfillment centers for fast pickups, and processing returns and exchanges for better customer service.

Cameron Khajavi, CIO of MIK Capital in New York, is also betting on a revival in the leading brick and mortar companies. He looks for winners and losers in terms of market share dynamics. In a post-pandemic world, he thinks monopoly-like dynamics will emerge in the retail sector.

“A lot of the emerging monopolies are companies that were thought of as potentially dead a couple of years ago because they were going to get runover by Amazon,” he said. “What people don’t realize is that they made requisite investments in their omnichannel business that have real return associated with them.”

He would rather buy American Eagle, Old Navy, or Dick’s Sporting Goods that are seeing triple digit growth in online sales at modest valuations than the pure ecommerce companies that are fairly extended on both a historical and relative basis. “I think the returns on some of these stocks are going to surprise massively to the upside,” he said.

Khajavi cited Target (ticker: TGT) as a perfect example of an emerging retail monopoly, with supply chain management and cost structures designed to create strong margins.

Ram Parameswaran, CIO of Octahedron Capital in San Francisco, said he was intrigued by Nike and Lululemon in an omnichannel future. But he also still believes that some of the internet first companies trading at “nosebleed valuations” have the potential to double or triple on a 5-year horizon.

While there is no “margin of safety” today, Parameswaran regretted past mistakes of not having the capability to imagine how big they can be. He used Wayfair as an example to argue that they have disproven the bear case completely with improving margins and profitability. “We can all be correct without actually being wrong,” he said.

Source: Shutterstock