Mark Zuckerberg issued a chilling warning to Meta employees: “If I had to bet, I’d say that this might be one of the worst downturns that we’ve seen in recent history.”

Such sentiment echoes our trip to the Bay Area last month. The discourse there deviated into the macro realm; this wasn’t our prior experience, when everyone extolled their startups and glorified their high-flying stocks.

The evolution of venture capitalists into macro experts fascinates us. Comments like “there is no end in sight,” however, and “we are already in a recession” leave us frazzled. Are VCs projecting their own experiences—the maximum pain in their portfolios—onto the rest of America? Everyone must be suffering because they are, right?

That is simply untrue. We believe Silicon Valley is experiencing a confined downturn, similar to the shale bust of 2015—16.

Source: Wired

Hunting for oil

Let’s go back in time.

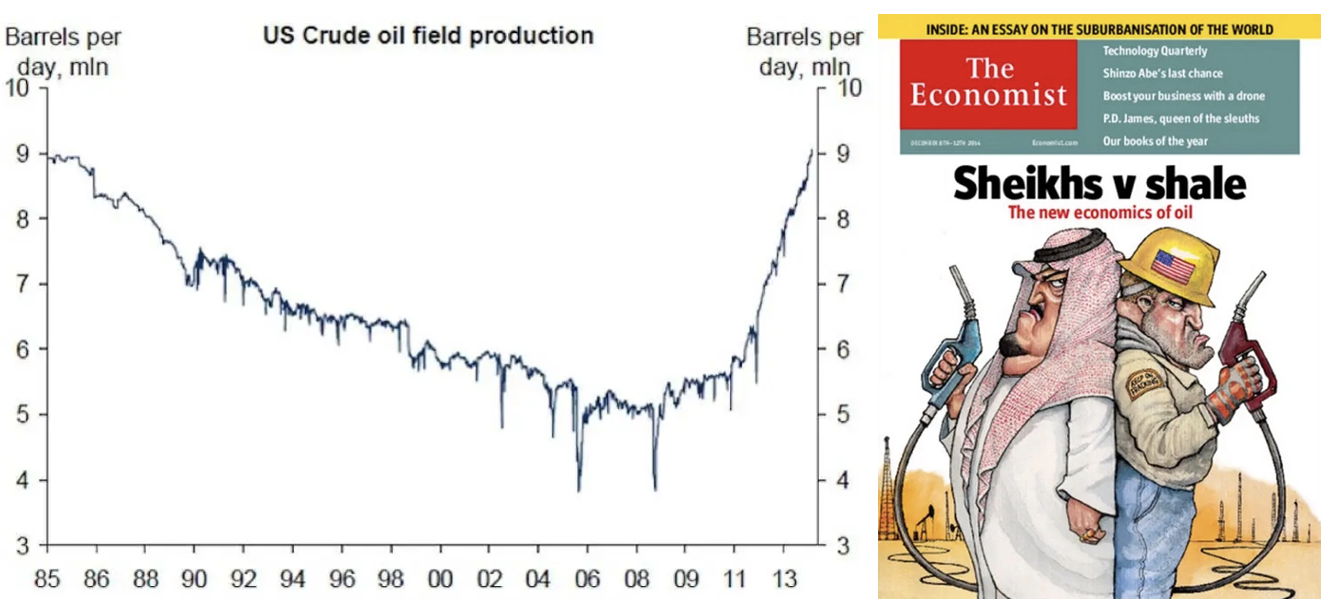

The innovations of horizontal drilling and hydraulic fracturing made it possible to extract oil from shale formations around the US. Although neither technology was entirely new, they were both improved upon and combined to increase the commercial viability of shale gas.

The Bakken formation in North Dakota was a shining star of the shale revolution. Oil companies and the businesses that support them were desperate for workers, and more than eighty thousand people flocked to the state from all over the country to meet that need. For seven straight years, North Dakota boasted the lowest unemployment rate in the country.

The fast-rising output of the Permian Basin and Eagle Ford saw Texas produce more oil than heavyweights like Brazil, Venezuela, Nigeria, Mexico and Kuwait. Between 2010 and 2015, US oil production increased from 5.4 million barrels per day to 9.4 million, closing on the all-time peak of just over 10 million set in 1970.

Flourishing innovation in the Bakken and Permian transformed these basins into the Silicon Valley of the energy sector: hubs of creative activity where engineers collaborated and competed to advance the frontiers of technology. The ideas they spawned, it was believed, could be deployed elsewhere as the likes of Argentina and China were armed with their own shale reserves and yearned to follow the US example.

Source: The Economist

Two factors drove the US shale boom. First, oil prices averaged above $90 a barrel from 2011 to 2014, which was enough to support the high infrastructure and drilling costs.

Second, low interest rates gave banks and private equity investors a strong incentive to lend, with $250 billion disbursed to shale producers in 2014. “You can make an argument that the Federal Reserve is entirely responsible for the fracking boom,” one private-equity titan said.

Shale producers blew through every penny they made and took out further loans to drill new wells. The revolution was profitless. The only thing keeping them afloat was a steady inflow of capital.

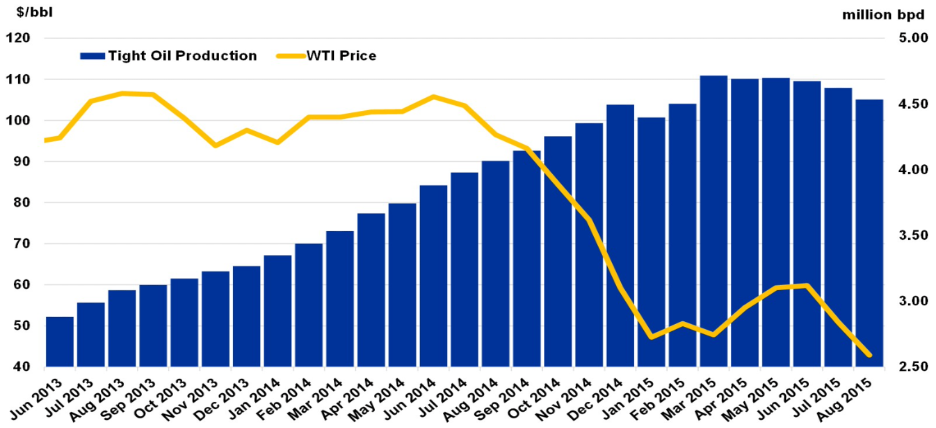

From a peak of $108 per barrel in June 2014, the price of crude oil fell 60 percent over the next seven months. Shale producers defied expectations and kept drilling. Many had hedged their production at higher prices. They became better at cutting costs, and their bankers kept rolling over their debt.

Back then, lenders and stock investors rewarded companies for high volumes. Executive pay that was linked to oil production rather than profits led to a drill-at-any-cost mentality. Profits would naturally flow later, so the thinking went.

The shale industry was pumping more oil than anyone needed. Consumers won, with the retail price of gasoline plummeting.

Source: IEA

The situation could not continue for long. Eventually, low prices caught up with the industry. Banks used oil reserves as collateral, and as oil prices fell, so did the value of the collateral. Many teams stopped drilling. Nearly half of new wells were sitting idle. The rig count—the number of oil and gas rigs actually drilling at a given time—fell from 1,920 in late 2014 to a low of 480 in early 2016.

In February 2016, the price of crude oil dropped to $26 a barrel. Shale companies laid off workers and cut spending. About 30 percent of the oil and gas industry’s debt was trading at distressed levels. Non-investment-grade energy bonds, the shale industry’s rocket fuel, yielded 25 percent. Some seventy companies with $56 billion in debt declared bankruptcy.

By nearly all accounts, the shale boom had gone bust. US oil production was down a million barrels a day by mid-2016. All told, more than 170,000 oil and gas jobs disappeared during the downturn.

After registering the fastest economic growth rate in the country, North Dakota’s growth declined to 0.15 percent in 2015—16. In large segments of the national economy, by contrast, it was business as usual. The overall unemployment rate kept falling. Anyone who didn’t work in the energy industry could be forgiven for not noticing it at all.

In effect, this was a localized downturn—severe in certain places but contained enough that it did not tip the US into a recession. The economy grew 1.6 percent in 2016, compared to 2.6 percent in 2015 and 2.4 percent in 2014.

Source: Oil Journal

From 2010 to 2020, large publicly traded US oil producers poured a total of $1.2 trillion into drilling, mostly in fracking. But they made only $819 billion in cash from their oil operations, a combined loss of $361 billion. The total return to shareholders in the sector in the last decade was effectively zero.

If we think of 2010 to 2014 as the shale industry’s first era, innovation leading to explosive production, and the second stage as being marked by capital discipline, then the third era, which we’re now in, is all about returning free cash flow to shareholders.

In first-quarter 2022, Chesapeake Energy posted adjusted free cash flow of $532 million, a record, and launched a $1 billion share and warrant repurchase program. Pioneer Natural Resources stated it will be returning 88 percent of its $2.3 billion first-quarter free cash flow to shareholders while maintaining oil-production growth of up to 5 percent. Continental Resources announced a fifth consecutive increase to its quarterly dividend.

The shale patch is on track for massive free cash flows of a combined $172 billion in 2022.

Source: Bloomberg

Hunting for unicorns

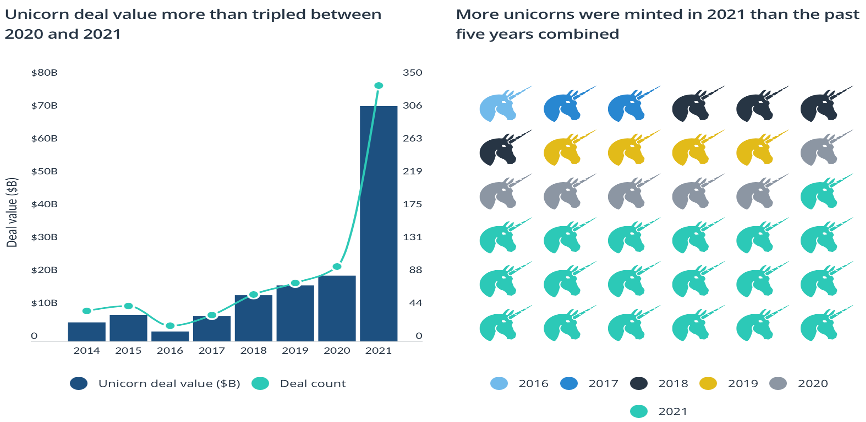

A decade-long run of low interest rates enabled investors to extend their horizons and take bigger risks on high-growth start-ups. According to Crunchbase, nearly $2.5 trillion was invested in venture capital deals worldwide between 2010 and 2021, with much of that coming just in the past few years.

Blitzscaling promised cash-guzzling startups with flimsy business models a “lightning-fast path to building massively valuable companies.” The VC industry was willing to subsidize years of massive losses in pursuit of market dominance. A focus on making money would entail sacrificing too much market share.

Technology reporter Kevin Roose called it a “benevolent Ponzi scheme,” one that results in a lot of very cool services being provided at or below cost to a select group of urban consumers. A constant supply of new money at ever-higher valuations kept the Silicon Valley boom chugging along.

There are more than six hundred unicorns in the US today, private startups valued at more than $1 billion, up from just thirty a decade ago. More unicorns were minted in 2021 than the previous five years combined. The global unicorn board hosts just shy of 1,300 unicorn companies. They are collectively valued at $4.5 trillion and have raised more than $750 billion in total equity.

Source: Pitchbook

But now the game is up. Investors are reconsidering the wisdom of funding business models that weaponize capital to subsidize customer acquisition. Founders are realizing that they can’t continue to operate with negative unit economics. According to venture capitalist Bill Gurley, “the unlearning process could be painful, surprising and unsettling to many.”

After peaking at nearly $15 trillion in November 2021, the market cap of about three hundred publicly traded tech companies with operations in San Francisco and the valley, at $10 trillion, is the lowest since 2013.

PitchBook estimates that more than 140 VC-backed firms that went public in America since 2020 have valuations lower than the total amount of venture funding they raised over their lifetimes. Many startups have shut down. Others are reigning in exceptionally high burn rates to increase their runway as the capital market window shuts.

Although the list of companies with layoffs runs long, around eight hundred startups, the total number of workers affected will be too small to move the labor market, even within the tech industry which employs more than twelve million people. This year, twenty-one thousand positions have been slashed from the Silicon Valley work force.

Meta has cut plans to hire engineers by at least 30 percent in addition to “turning up the heat” on performance management in order to weed out staffers who are unable to meet more aggressive goals. “Realistically, there are probably a bunch of people at the company who shouldn’t be here,” Zuckerberg confessed.

Uber CEO Dara Khosrowshahi told staff that the ride-hailing giant will “treat hiring as a privilege,” and he pledged to be “hardcore about costs across the board.”

“While investors don’t run the company, they do own the company—and they’ve entrusted us with running it well,” he said in a memo. “Now it’s about free cash flow. We can (and should) get there fast.” Uber’s FCF margin is estimated to be 2.3 percent in 2022 and to increase to 9.2 percent by 2024.

Amazon enjoyed positive free cash flow in its first quarter as a public company in 1997. Conversely many startups aren’t there yet—and won’t be for many years.

Source: Wired

Sequencing matters when boom turns to bust. We identify three stages—down, up, down—and break down the performance among different qualities of stocks.

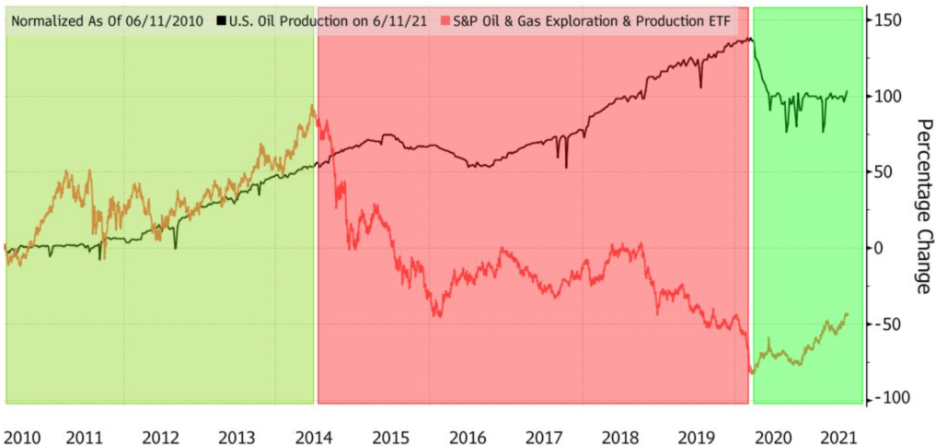

EOG Resources, dubbed “the Apple of oil,” was one of the great success stories of the shale boom. From mid-2014 to early-2016, the stock fell 52 percent. Then it doubled to a new all-time high in October 2018 before another major leg down.

(Technology stalwarts Apple and Microsoft are down 29 percent and 31 percent, respectively, from their January 2022 peak. We expect both stocks to make new all-time highs in the upcoming third bull phase.)

The S&P 500 Energy Sector ETF (XLE) peaked in June 2014 and fell 51 percent by January 2016; it then rallied 60 percent by October 2018 with a lot of dispersion (Exxon lagged while Chevron nearly managed to reclaim its prior high) before dropping another 71 percent through March 2020.

(FANG stocks—Facebook, Amazon, Netflix, and Google—are down 54 percent from the peak, on average. While they will rally with the market, we don’t see them surpassing their recent highs. We would not be surprised if the total return for FANG stocks is effectively zero from 2018 to 2028, much like it was for the large-cap energy stocks from 2010 to 2020.)

The more speculative energy stocks grouped into the S&P 500 Oil & Gas Exploration and Production ETF (XOP) plunged 73 percent from mid-2014 to early-2016; followed by a 100 percent gain in twelve months; and another 83 percent decline to the March 2020 low.

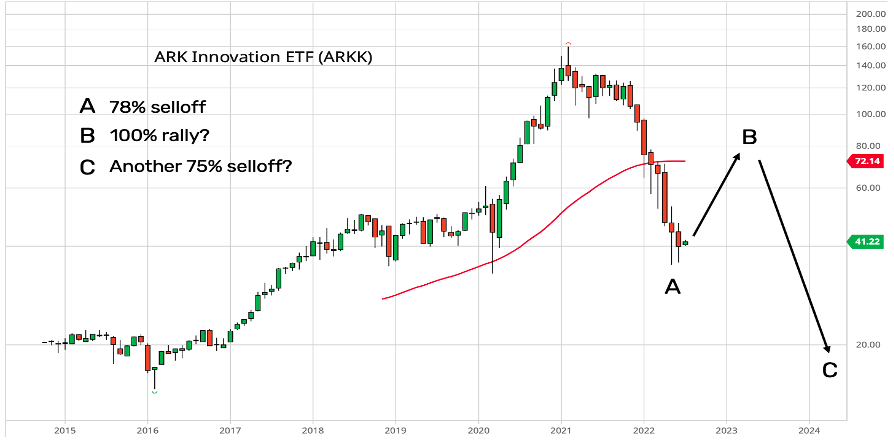

(Since February 2021, Cathie Wood’s Ark Innovation Fund (ARKK) has declined 78 percent; we’re expecting ARKK to double in value now during this second stage before falling another 75 percent to its final low by the middle of the decade.)

Make no mistake, now is not the time to be bearish. A world in which ARKK is up 100 percent suggests that the S&P 500 will also rise 35 percent. As inconceivable as it may seem, that would push the S&P 500 to a new all-time high above 5,000. Are you ready?

Source: Barchart.com