“Of course, all life is a process of breaking down, but the blows that do the dramatic side of the work—the big sudden blows that come, or seem to come, from outside—the ones you remember and blame things on and, in moments of weakness, tell your friends about, don’t show their effect all at once.”

- F. Scott Fitzgerald, The Crack Up

The general consensus among Silicon Valley insiders is that the problems with Softbank’s Vision Fund and its portfolio companies are isolated—and not quite emblematic of a wider trend of blitzscaling across venture-backed companies. This confidence comes from a record year of VC exits, valued at $256.4 billion across 882 liquidity events, crowning venture capitalists as the new Masters of the Universe.

The Vision Fund, on the other hand, has seen the value of its holdings plummet more than $50 billion in 2019. Approximately 12,000 employees have been fired by companies partly owned by SoftBank, including Uber, WeWork, Didi, Rappi, Fair, Wag, Katerra, Getaround, Zume, and Oyo. As expected, Masa Son has failed to raise a second Vision Fund at the scale he hoped and promised. The game is up. Softbank has walked away from investing in several startups. According to Axios reporter Dan Primack, this is going to have “an earthquake-like impact on the future funding environment.”

According to Crunchbase, over $1.5 trillion was invested in venture capital deals worldwide between 2010 and 2019, with most of that coming in just the past few years. Global funding rounds across all stages of the venture-backed company lifecycle peaked in 2018 at $320 billion, surpassing the high-water mark left by the dot-com deluge. In 2019, global venture deal value declined 8 percent to $295 billion. US deal value fell 3 percent to $136.5 billion.

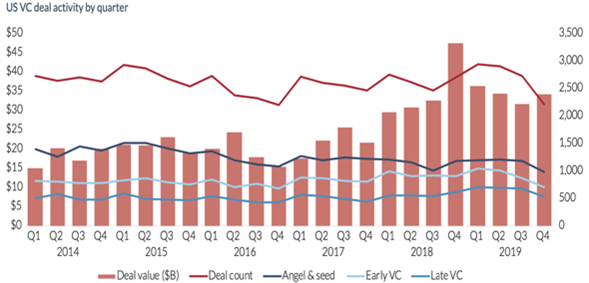

Looking at deal activity on a quarter-to-quarter basis, one suddenly realizes that the climax is over. Deal activity in the US peaked in the fourth quarter of 2018. Venture funds may be announcing larger and larger fund sizes, but liquidity is retreating beneath the surface.

Source: NVCA-PitchBook Venture Monitor

Investors are reconsidering the wisdom of funding business models that weaponize capital to subsidize customer acquisition. Founders are learning that they can’t continue to operate with negative unit economics. Casper, Peleton, Uber, WeWork, DoorDash and Postmates collectively lost nearly $14 billion in 2019. But switching business strategies can be hard. The path to profits is through higher prices for their products and services—for Uber and Lyft, for scooters, for mattresses, for food delivery, and more—which will severely hurt growth. Many consumer tech companies will be unable to achieve the milestones necessary for the next round of funding at a higher valuation.

Brandless, one of Softbank’s highest-profile companies, saw its revenues drop by half from a year earlier as it scaled back spending on marketing and moved to higher margin products. The company is shutting down just two-and-a-half years after its launch. Lime, one of the fastest startups to unicorn status, has announced plans to cease operations in a dozen cities. In China, more than 330 startups shut down operations last year, having collectively raised $2.5 billion from investors.

We believe Softbank’s troubles are just the beginning. Silicon Valley’s bear market should spread far and wide. There will be many more layoffs across the tech industry, as companies embrace austerity. Closing deals will take longer. Valuations will take a major hit. Founders will end up raising significantly less, while offering investors additional downside protections. We may see a drop-off in entrepreneurial activity in almost every city and in almost every industry.

Any hope that Airbnb’s public debut will revive the tech IPO market and bring back the good times will prove fleeting given the impact of Covid-19 on its business. Allocators need to start worrying about the returns from their venture portfolios. As per Bill Gurley, “Silicon Valley is way more correlated with Nasdaq than anyone admits.”

According to University of Florida professor Jay Ritter, the percentage of IPOs with negative earnings over the prior 12 months is 74 percent and the percentage of US listed companies losing money is close to 40 percent, the highest level since the late 1990s outside of post-recession periods.

This brings to mind F. Scott Fitzgerald’s commentary from The Jazz Age when people were living far beyond their means, and they knew it, but they simply didn’t care. “Even when you were broke, you didn’t worry about money, because it was in such profusion around you,” he wrote.

That is no longer the case. The Bloomberg US Startups Barometer, which incorporates both the money flowing into VC-backed startups as well as the exits that are making money for investors, is crashing. The utter confidence of VCs—the essential prop of the Silicon Valley Age—is about to receive an enormous jolt from the repricing of unprofitable companies. Softbank has blundered and the most expensive orgy in history is over.

Bloomberg US Startups Barometer (BSTAVCDV:IND)

Source: Bloomberg

Photo: The New York Times