We have had a lot of time to think through the outbreak of coronavirus (Covid-19) and its impact on the global economy and financial markets.

First, it is important to keep in mind that global stocks were ripe for a risk off period after rallying 15 percent from the beginning of the fourth quarter. All we needed was a catalyst.

In the week before the epidemiological alert on the new coronavirus on January 16, trading volume at online and discount brokers exploded and small trader call buying jumped to 46 percent—the highest level since a reading of 47 percent in October 2007, ahead of Dow’s 54 percent slide. As we asked in January, “Could we be seeing a buying climax?” The all-time high in small trader call buying was 52 percent in March 2000 at the height of the dot-com bubble.

The public was fully committed to the bullish uptrend and could easily have been spooked by any negative developments. The VIX index was hovering near its lowest level in two years.

Global stocks and oil prices fell sharply, spurred by the concern that the fast-spreading virus outbreak in China cannot be contained. Indeed, it has already begun to infect people in at least 60 countries, and it will travel further before it’s done. There are growing calls of a “global pandemic.”

Source: Axios

Covid-19 has killed at least 2,900 people and infected more than 85,000 globally. As it currently stands, 94 percent of the global cases are within mainland China (and 81 percent in Hubei province). Most cases are not life-threatening, but its greater spread has already led to more deaths than its related coronaviruses. Mortality rates are skewed heavily towards older individuals with pre-existing conditions. The SARS outbreak and MERS each killed fewer than 1,000 people.

It is tempting to panic now—but we shouldn’t.

The advent of social media exaggerates our fears with millions of Chinese quarantined, disturbing videos of people collapsing in the streets of Wuhan, empty train stations, stores running out of masks, and scenes from airports with over 200,000 flights curtailed.

We are conditioned to look for any cause for alarm, making the danger seem bigger still. What’s forgotten is the current influenza season in the US has so far hospitalized 280,000 people and claimed 16,000 lives. Influenza kills about 400,000 people worldwide every year.

Investors have long distrusted China’s economic data and now they claim their health statistics are fabricated too. This feeds into the panic. We have read articles in mainstream Western media titled, “Wuhan virus cover-up exposes a China built on lies”; “How China’s incompetence endangered the world”; and “Coronavirus and the Blindness of Authoritarianism.”

As readers know, we never took issue with China’s growth figures and have no reason to believe their coronavirus data is made up either. On February 24, the World Health Organization (WHO) said China’s daily tally of new cases peaked and then plateaued between January 23 and February 2 and has been declining steadily since.

Bruce Aylward, who led the international mission to learn about the virus and China’s response said that he did not see evidence that a large number of mild cases of the disease are evading detection. “We have to be careful about how we look at China’s data. They know how to keep people alive,” he said.

The seriousness with which governments and health organizations around the world are taking Covid-19 should slow down the outbreak. The most severe period of initial infection could also soon fade as the weather warms up because respiratory diseases flourish in the cold season. Eventually, we see it settle as an endemic disease like a common cold or a respiratory virus. We will have to learn live with the threat in the 2020s. “Most influenza pandemics last two to three years,” according to Peter White, professor of virology at the University of New South Wales. “That’s how long it takes before herd immunity is built up.

Source: Associated Press

Nearly 23,000 patients infected with Covid-19 have so far recovered and been discharged from hospitals. China’s National Health Commission also reported a drop in new infections to 406, with only five outside Hubei, as the country makes progress in its fight against the epidemic. At least six provinces have lowered their emergency response levels from the highest rating. Factories are resuming work, traffic restrictions are being relaxed, and Apple is reopening several stores.

Health officials say it might take 28 days to safely say that an area is free of coronavirus. This suggests to us that the situation should largely be brought under control by late March. About 200 million migrant workers need to return to the cities where they worked following the Spring Festival holiday.

SARS lasted six months. We assume that Covid-19 will last longer and the economic impact will be harder felt. However, China does not face a major economic meltdown, as some analysts suggest. The country will return to its structurally slower trend growth after a sharp, short-term negative blow to the economy. More than two thirds of provinces have lowered their growth targets for the year.

Source: Capital Economics

We know China’s nominal retail sales growth slowed from 9.2 percent in the first quarter of 2003 to 4.3 percent in May as a result of SARS, but then rebounded to 9.8 percent in July. Covid-19 is a much bigger shock to the confidence of households and small and medium-sized enterprises (SMEs), and we expect the negative impact to only recede after the second quarter. Consumer caution will continue long after the disease has hit its peak.

Dun and Bradstreet estimate there are around 22 million businesses—or 90 percent of all active businesses in China—within the regions impacted by the new coronavirus. A survey of SMEs conducted by Tsinghua and Peking universities found that 85 percent would be unable to survive for more than three months under the current conditions.

Beijing has acknowledged this issue and is focused on minimizing the social and economic fallout. Companies have been banned from sacking workers; mandatory monthly employer contributions for social security, unemployment and housing provident benefits have been reduced to help firms make payroll; banks have been ordered to provide short-term credit lines to SMEs and defer loan payments; and large state-owned banks have been urged to increase loans to micro and small businesses by no less than 30 percent year-on-year in the first half of 2020.

SMEs are responsible for creating two-thirds of new employment in the country and some 87 million Chinese students will graduate this year. The resumption rate for SMEs only stands at 30 percent currently.

As work returns to normal and economic activity stabilizes, we expect a more proactive fiscal policy. Xi Jinping wants to achieve several economic milestones in time for the 2021 centenary of the party’s establishment. The shift from financial deleveraging to releveraging, the boost from increased fiscal stimulus, and the improvement in news flow related to the coronavirus (and the US-China trade war) should benefit Chinese assets.

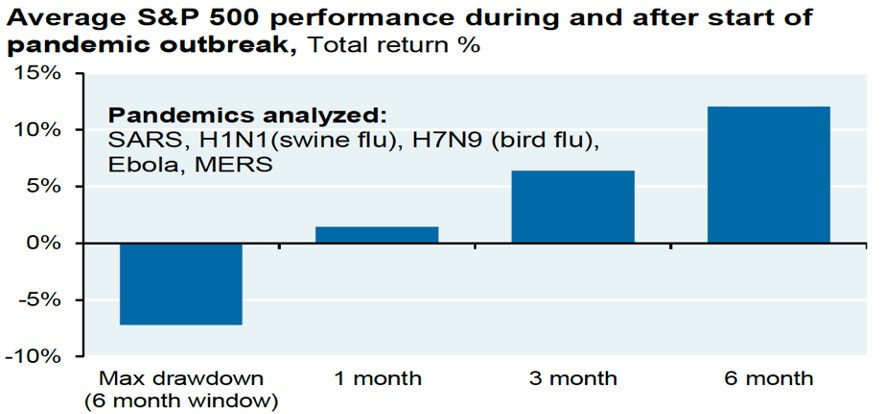

Ned Davis Research surveyed a number of health emergencies, including the outbreaks of SARS in 2003, bird flu in 2004, Ebola in 2014, and zika virus in 2016. They found that stocks were weak leading up to the official declaration of a global emergency, before steadily moving higher after the announcement. In other words, the stock market is already factoring in the risk when WHO declares a global emergency.

As it happens, WHO declared the outbreak of coronavirus a global health emergency on January 30. Chinese stocks are up 5 percent since the selling climax. Markets are now reacting to the jump in cases outside China but the correction in US stocks has swiftly exceeded the past performance during a pandemic outbreak.

For at least the first half of this year, companies will get a “pass” on earnings results. Moreover, the global liquidity backdrop is still supportive of higher multiples. Rick Reider, BlackRock’s CIO of Global Fixed Income, estimates liquidity injections in the fourth quarter of last year retraced more than half of the 2018-19 contraction. Several EM countries have lowered policy rates too this month as the virus has spread. This provides important support for financial markets once volatility subsides.

Source: J.P. Morgan

In 2018, President Trump’s tax cuts and fiscal stimulus package fueled US growth and the Fed hiked rates by four quarter points. China, meanwhile, was pursuing financial deleveraging to reign in worryingly high debt levels. The shadow banking sector became the target of a regulatory crackdown and fiscal policy did not play the countercyclical role of bolstering growth. As a result, US-China policy divergence reached unprecedented levels. The dollar gained 6 percent and US stocks outperformed Chinese stocks by 40 percent.

The coronavirus outbreak will reverse the policy divergence from 2018. The US is running a large fiscal deficit and stimulus from Trump’s tax cuts is wearing off. The fiscal impact is expected to be slightly contractionary in 2020 and 2021. Since September, the Fed has also been intervening directly in the repo market but is expected to accelerate the pace of its withdrawal from short-term funding market in the second quarter.

In contrast, China has pumped billions into the financial system, slashed interest rates, cut red tape and taxes in a bevy of emergency responses to soften the negative impact of Covid-19 on its economy. China will pursue loose fiscal and credit policies to spur demand and keep growth going.

Could the counterintuitive effect of coronavirus be to spark a period of sustained outperformance by Chinese assets? In February, Chinese stocks were up 8 percent while US stocks fell 8 percent. The dollar-yuan exchange rate was flat. This is the signal amid the noise.

Photo: Shutterstock