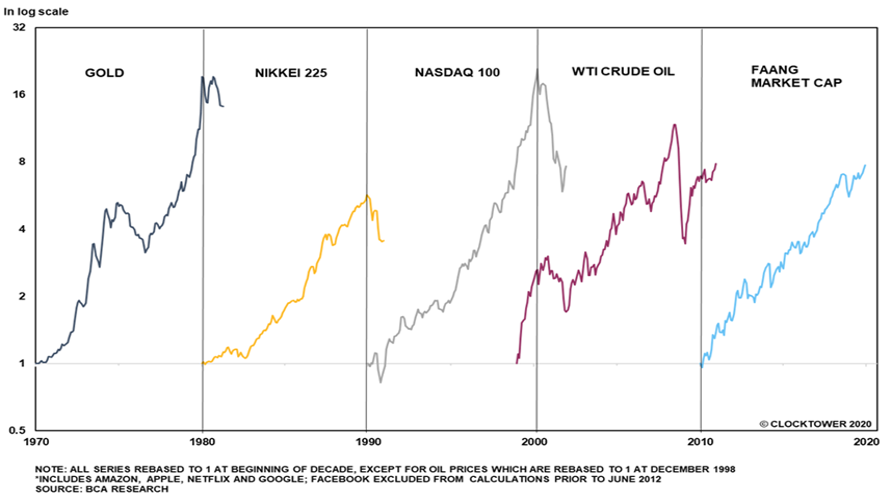

Every decade, there is a “theme” that captures the zeitgeist and turns into an investment mania. It was gold in the 1970s, Japan in the 1980s, Nasdaq in the 1990s, and China and commodities in the 2000s. As more investors are lured in by the big gains, the theme turns into a classic bubble, which ultimately pops.

According to the Speaker, nothing captured the investment zeitgeist of the 2010s decade better than Marc Andreessen’s prescient 2011 article, “Software is Eating the World.” The internet pioneer foresaw a dramatic and broad technological and economic shift in which software companies were poised to take over large swathes of the economy.

A decade later software stocks have tripled the market’s return and no major industry has a higher valuation. Facebook, Amazon, Apple, Google’s parent Alphabet and Microsoft have added to the stock market a total of $4.3 trillion in market capitalization. That is more than the value of the UK stock market and nearly as much as China’s mainland stock market. The technology sector now accounts for more than 25 percent of the US stock market’s value. Silicon Valley unicorn valuations have also risen from $30 billion to $600 billion over this period.

“However, as we are at the end of another decade, the software sector is dangerously on the cusp of a precipitous fall,” the Speaker warned, who felt in minority with his contrarian thinking.

Source: Clocktower Group

The common counterpoint was that we are still in the early stages of the “softwarization” of the global economy and many industries are yet to be disrupted. These companies are growing fast and generating strong cash flows. “It’s hard to see that stop abruptly,” said one participant.

The Speaker nodded in agreement. He in fact expects these companies to continue to grow revenues (even through an economic downturn). “But what investors are getting wrong is that software valuations face a steep contraction.” He noted the example of Cisco between 2004 and 2014 when the company more than doubled its earnings, yet the stock was trading at the same level as in 2004 because the P/E ratio halved from 33 to 16.

“Even if Salesforce’s revenue more than doubles over a five-year period, the stock may not be any higher and could, in fact, be lower from today’s levels if the company just trades at a lower multiple of 5 times sales. Valuations matter, even if investors seem to have forgotten lessons from the past.”

One of the participants, who is a distressed credit investor, was attentive to an unraveling along the following lines: a falling stock market pushes up leverage ratio for companies which triggers widespread rating downgrades, more corporate debt falls into a sub-investment grade rating which raises concerns about roll-over risk, a lesser ability to issue new debt, combined with a weaker earnings outlook, reduces cash available for stock buybacks, this adds downward pressure on equity prices and upward momentum on leverage ratios. “Once people are frightened, that’s when I’ll make money. Right now, everything is the most expensive I’ve ever seen.”

Unfortunately, it is easier to discern the end of investment zeitgeists rather than the beginning. A number of participants suggested that fintech could be a strong candidate for the next decade.

Photo: Pexels