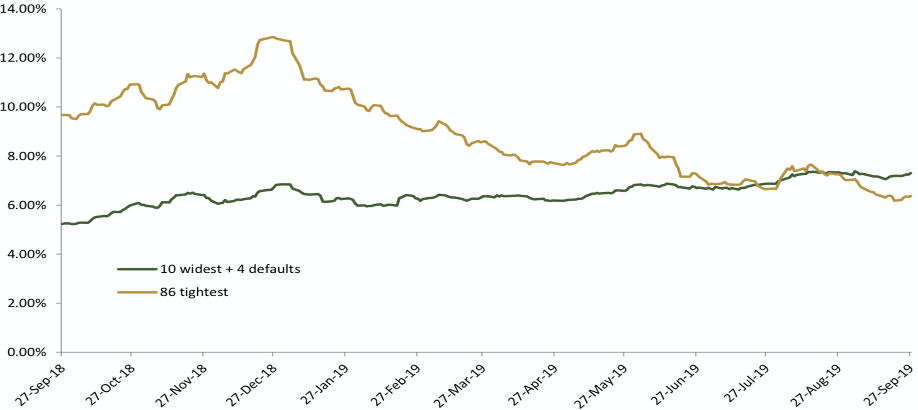

The chart plots constituents of the US High Yield 31 index (credit default swaps), which is composed of 100 hundred liquid North American entities with high yield credit ratings that trade in the CDS market. The green line represents the expected loss in the 10 widest names plus 4 defaulted names. The brown line shows the expected loss in the 86 remaining constituents.

The Speaker finds it interesting that the cumulative expected loss of the 86 names in the HY portfolio is now less than the cumulative expected loss on the 10 widest names plus 4 defaulted names. This has not happened before and suggests the gap between the haves (able to access credit) and have-nots (shut out) has widened.

What puzzles him is that if liquidity is so abundant, why are we seeing this dispersion? This is creating alpha opportunities as companies are very quickly priced to default.

Source: Markit (US CDX HY31 Index)

High yield corporate bonds posted solid total returns of 14% on average in 2019. But the US high yield default rate also finished 2019 at 3.3 percent, the highest level since 2016 and above the non-recessionary 2.4 percent level. Default volume tallied $38.6 billion, up 32 percent versus 2018, as the energy sector was in most pain with $17 billion in default volume and a 9.5 percent default rate. The year-end 2020 default rate is expected to rise to 3.5 percent.

One of the participants who is a credit specialist observed that if you adjust for some idiosyncratic names in the high yield index, spreads are tighter today than ever before. He recommends buying credit protection through credit default swap positions in the European iTraxx Crossover index.

Listening to this discussion on the intricacies of the credit cycle, a macro investor noted that credit usually leads equities at macro turning points, and the “signal” from credit markets does not support a “melt-up” in equity markets. The basic idea is the combined growth in corporate profits and corporate debt drives credit spreads through the macroeconomic cycle, which, in turn, leads equity markets.

Photo: Pexels