Climate change will become a much more important focus this decade, which will present some unique investing opportunities. The most obvious one, according to the Speaker, is to buy stocks of electric vehicle (EV) makers Tesla and Nio. He has been a long-time bull and believes that the market is still underestimating the value of these brands.

Tesla has more than quadrupled since September in an epic short squeeze following an earnings beat, better than expected delivery numbers, and the factory opening in China. The stock is now up 112 percent since the start of the year. China’s Nio has received less focus but the stock has more than tripled over the same time frame as well. Nio is particularly interesting, the Speaker said, as the company has sold only 20,000 cars but has 1 million followers on its social channels.

While most investors are beguiled by this run up in EV stocks, the Speaker believes the market is simply waking up to the reality that global warming and the changing regularity environment around the world makes it pretty clear that the future is electric. The growth of EV sales combined with the decline in overall auto sales means electric vehicles now make up almost 5 percent of total sales. By 2025, this will rise to 25 percent.

Source: Bloomberg

China’s sales of “alternative energy vehicles”—mostly electric, with some hybrids and a small number of natural gas combustion engines—are nearly 1.5 million. Meanwhile, sales of all passenger vehicles peaked at close to 25 million in the 2018 and are now below 22 million. China plans to ban the sale of all petrol or diesel cars by 2030. India is planning the same and the Speaker expects many other countries to follow.

A ban on selling new petrol, diesel or hybrid cars in the UK was just brought forward from 2040 to 2035 at the latest after experts said that 2040 would be too late if the UK wants to achieve its target of emitting virtually zero carbon by 2050. People will only be able to buy electric or hydrogen cars and vans, once the ban comes into effect.

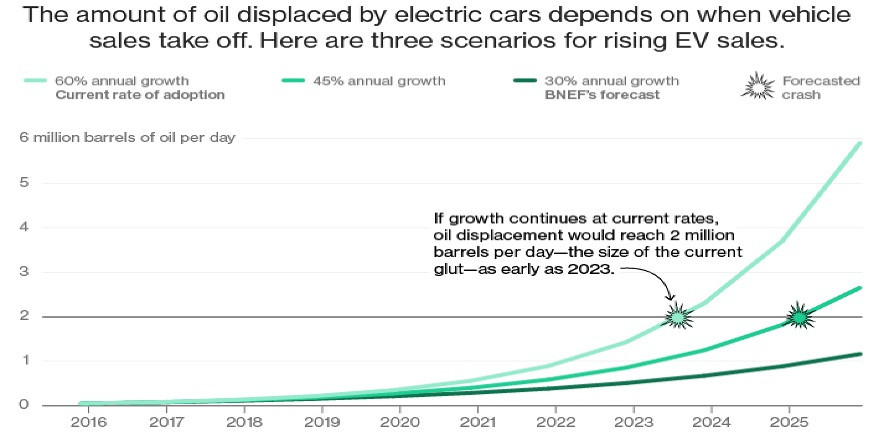

The Speaker believes that the market is underrating the adoption curve of EVs, which means the woes for the embattled car industry will only worsen. He is expecting oil displacement to occur at an even faster pace than what is presented in the chart. Nearly a quarter of oil demand comes from the light commercial passenger vehicles.

“EV companies are the next FANGs,” he said, in conclusion.

Photo: Pexels