The International Monetary Fund (IMF) has warned that the global economy in 2020 will suffer its worst recession since the Great Depression because of the coronavirus pandemic. Income per capita is projected to shrink for over 170 countries.

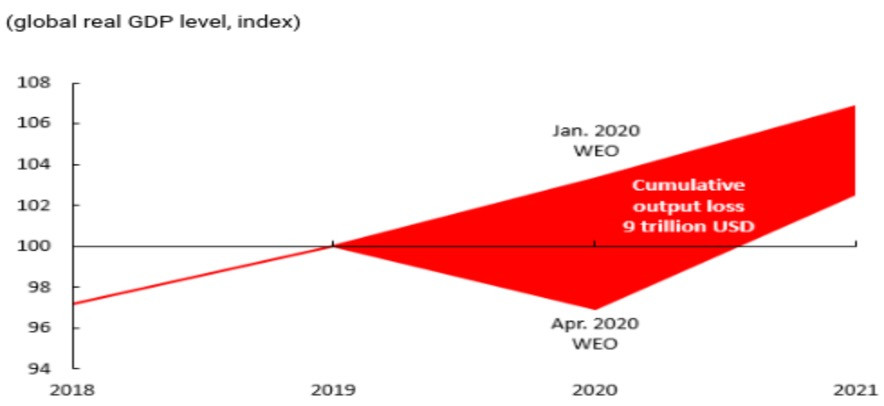

The Speaker’s chart, drawn from the latest IMF study, shows that the cumulative loss to global GDP over 2020 and 2021 could be around $9 trillion, greater than the economies of Japan and Germany, combined.

Source: International Monetary Fund

The IMF sees global GDP contracting by 3 percent this year and then rebounding to 5.8 percent in 2021. “That’s superior than a V-shaped recovery which seems implausible,” said the Speaker. He anticipates downward revisions to those projections.

He also finds it odd that the S&P 500 has rallied 30 percent over the past month, whilst the US economy has wiped out a decade of job gains. America now has 22 million people unemployed.

The coronavirus has changed the world profoundly in many respects and there is considerable uncertainty about what the economic landscape will look like when we emerge from this lockdown. We can’t fathom the depth and duration of the contraction across economies. And it remains to be seen whether the unprecedented policy actions taken around the world are effective in preventing widespread firm bankruptcies, extended job losses, and system-wide financial strains.

“Ultimately, most of the fiscal spending announced is just compensation for lost income,” noted a participant. “This is boosting the social safety net. We can’t call it stimulus.”

What’s also not clear is how consumer behavior will change after months of social distancing. Americans over 55, who are most vulnerable to Covid-19, account for 40 percent of consumer spending. “What are the chances short-term quarantine turns into long-term isolationism?” Another participant noted the pandemic may not recede in the second half of this year leading to longer containment periods.

Another participant made the observation that the market is responding to the news of “virus flattening,” as there is increasing evidence that Italy and New York are turning a corner in their efforts to fight Covid-19. When the economy reopens, that’s when the market will be more sensitive to the economic damage.

It was also noted that every major crash dating to 1929 has had strong bear market rallies. No one believed the current one was sustainable, which has already exceeded the typical gain. It was also said the average stock has not performed as well as the broader market.

Photo: Shutterstock