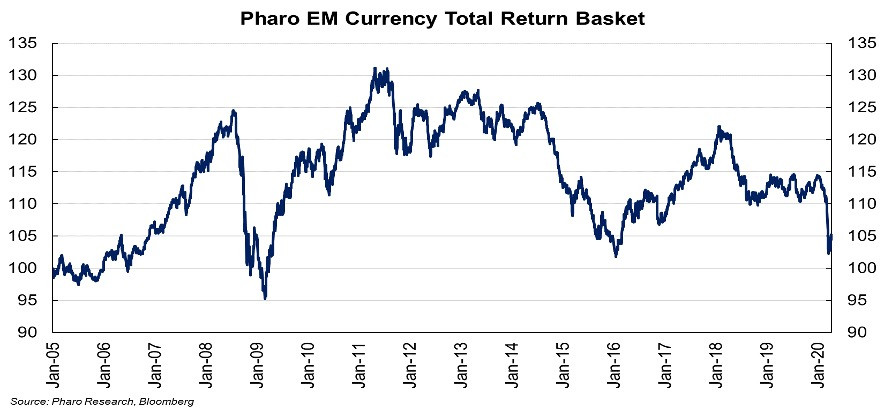

Emerging market (EM) currencies are not a very “sexy” asset class, said the Speaker. His chart, which tracks the total return performance of the 21 most liquid EM currencies, shows there have been only few opportunities on the long side if they were well timed: 2006-07, 2009-11, and 2016-17. Over a 15-year period, a long-term investor would have barely eked out a positive gain.

Source: Bloomberg

Looking ahead, the Speaker is bearish on the asset class. The drop in EM currencies due to the pandemic is not significant compared to previous crashes.

During the Great Recession, EM currencies fell 24 percent. From 2014-16, as oil prices crashed, EM currencies fell 18 percent. “Contrast this with the 13 percent decline in 2020, despite a larger economic shock, the collapse in commodity prices, and EM central banks pursuing unorthodox policies which they did not do in 2008.”

For the first time, a growing number of EM countries are embarking on QE, including central banks in Colombia, Poland, the Philippines, Turkey, South Africa and perhaps Brazil.

This has been the worst quarter for carry trades since 1999. Emerging markets have experienced the sharpest portfolio flow reversal on record—about $100 billion or 0.4 percent of their GDP—posing stark challenges to more vulnerable countries. At the end of 2019, almost half of the lowest-income countries in the world were already in debt distress.

The swap and repo facilities announced by the Fed eased dollar funding conditions, but still getting all-important dollars will be harder with exports of goods and services severely curtailed, and tourism and remittances hit hard. EM countries have around $5.5 trillion of debt coming due this year, with a sizable percentage held by investors in the developed world.

The Speaker anticipates that EM liquidation and risk reduction will continue for at least another six months. Historically, global risk assets tend to bottom together, which implies that if the Speaker is right, stocks may retest their lows.

Photo: Unsplash