Rumi said as you start to walk on the way, the way appears. Since we are laying considerable weight on the prospect of a new bull market, we had better define what we mean by it.

First, consider the sequence of events in 2008. Lehman went bankrupt on September 15. Congress did not pass the TARP bailout until October 3 and the Fed didn’t introduce quantitative easing until November. The S&P 500 fell 30 percent from mid-September to mid-November and was down 46 percent from the October 2007 peak.

Markets had to wait until after the presidential election for fiscal stimulus. The $787 billion American Recovery and Reinvestment Act was passed in February. By then, the S&P 500 was down another 20 percent.

Contrast this with today. The fiscal and monetary backstop was rapidly put in place by the Fed and Congress in response to the pandemic—$8 trillion from the Fed and $3 trillion from Congress. There is bipartisan consensus that more needs to be done and another economic rescue package is on the way. The Fed has given itself extraordinary new powers to snap up junk debt and make loans to companies.

The S&P 500 fell 34 percent in 23 days. “This is a bear market at warp speed,” said Jim Paulsen, chief investment strategist at the Leuthold Group. In ten weeks, Fed asset holdings grew as much as what it took nearly 80 weeks to buy during the Great Recession. With the government helping to bridge those most impacted by Covid-19, it is possible this recession is one of the shortest on record.

It took four years to get back to peak earnings after the Great Recession. During the Great Depression it took over a decade. Even if we don’t see a V-shaped recovery, we should return to peak earnings quicker than previous episodes.

So far, 55 percent of S&P 500 companies have reported first quarter results. The blended earnings decline (combines actual results for companies that have reported and estimated results for companies that have yet to report) is -13.7 percent, according to FactSet data.

Looking at future quarters, analysts predict a (year-over-year) decline in earnings in the second quarter (-36 percent), third quarter (-20.1 percent), and fourth quarter (-9.4 percent). For the full year, Goldman sees S&P 500’s earnings fall to $110 a share from $163 in 2019, a 33 percent decline. Bank of America lowered its forecast to $115 a share, which implies a 29 percent slump. This is worse than the drop in 2008, which was about 20 percent.

We are more optimistic. Of the 11 sectors of the S&P 500, six are reporting year-over-year growth in earnings in the first quarter, led by Health Care, Consumer Staples, and Information Technology. These three sectors make up nearly 50 percent of the S&P 500’s overall market cap. If we combine the other three sectors (Utilities, Communications and Real Estate), 65 percent of S&P 500 constituents by weight reported earnings growth in the first quarter.

The five sectors that are reporting a year-over-year decline in earnings are Consumer Discretionary, Financials, Industrials, Materials, and Energy.

For the second quarter, earnings for the Utility sector (3.5 percent of the S&P 500 market cap) are expected to be positive. We assume Health Care, Consumer Staples, and Information Technology will see a combined drop of 10 percent, while Communications and Real Estate see earnings decline 20 percent. We also conservatively guess the other five sectors (Consumer Discretionary, Financials, Industrials, Materials, and Energy) see earnings crash 50 percent.

Putting it all together, we come to second quarter earnings decline of 25 percent for S&P 500 companies, which is well above market expectations. For the full year, we think that earnings will not fall more than 20 percent, which implies $130 a share. In 2021, earnings could pick up to $150.

In January, we argued that valuation multiples have peaked for the cycle. But now, with a near-zero target range for the Fed funds rate and the dual benefits of record monetary and fiscal stimulus, we think valuation ranges can expand higher. The S&P 500’s forward price-to-earnings multiple may trade up to 22-times. That would bring us back to 3,300 on the S&P 500 based on next year’s earnings.

What explains the huge disconnect between the dire state of the US economy and rising stock market is that: 1) the composition of the S&P 500 is quite different from the economy, and 2) earnings calculated for the S&P 500 have an upward bias because the index includes the largest companies by market value that are also currently benefiting the most from the Covid-19 disruption. The top two sectors today (Tech and Health Care) make up half of the S&P 500’s market cap.

The Information Technology sector represented 15 percent of the S&P 500’s market cap in 2008. This grew to 20 percent in 2015, 23 percent in 2019, and is now running up to 26 percent. If we include Amazon, Google, and Facebook, which are categorized in other sectors, the total weight of technology stocks in the S&P 500 increases above 35 percent. Meantime, the tech industry represents just 10 percent of the American economy.

The S&P 500 is becoming increasingly concentrated, particularly among the largest technology names. The top 10 tech stocks, worth $7 trillion, have a weight of 30 percent in the S&P 500 index. Microsoft, Apple, and Amazon are each larger than the four smallest sectors of the market.

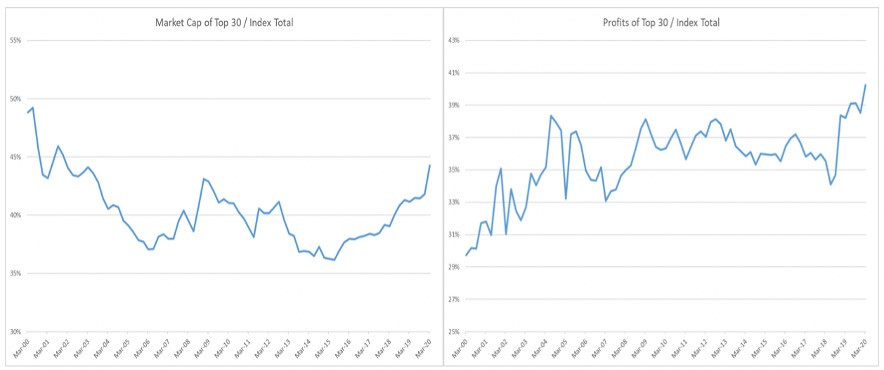

The top 30 S&P 500 companies have a weight of nearly 45 percent in the index. Five years ago, this was 36 percent. Over the same period, profits for those thirty companies jumped from 36 percent to nearly 41 percent of the index. Profits have gotten more concentrated.

Source: Bloomberg

Stocks can keep climbing even if news about the economy isn’t getting much better. The market cap heavyweights are lifting the entire S&P 500. Passively managed equity funds still account for virtually all the inflows.

In Homer’s The Iliad, the Trojan prince Hector speaks, after being struck a death blow by Achilles, “My doom has come upon me; let me not then die ingloriously and without a struggle. But let me first do some great thing that shall be told among men hereafter.”

For the S&P 500 to extend its rally through the worst economic decline since the Great Depression would be a “great thing” to be told for the ages.

Photo: Shutterstock