For how long will the UAW be on strike? Will there be a government shutdown at the end of the month? Does consumer spending suffer once student loan payments resume? What is the ceiling for bond yields?

No wonder Fed chief Jerome Powell used the word “uncertain” eleven times during the most recent FOMC meeting. He used the term “careful” sixteen times, mostly when outlining how the Fed will proceed.

Our thought bubble: Congratulations!

The ever-growing wall of worry has reached completion. We were only concerned about a recession at the start of the year. Now the bricks are piled so high that it blocks sight of the ongoing secular bull market.

But: Aren’t stocks expensive? This could be China’s Minsky moment, after all. If Russia uses oil as a weapon this winter, what then?

Each risk adds another brick in the wall.

Context: After two vicious selloffs in a three-year period (early 2020 and 2022), we dread a recurrence and will take every precaution to prevent it. So the wall just serves as a defense mechanism.

Investors really overestimate the risks and underestimate the potential returns as a result of this recency bias. The bricks are constant reminders of the kind of pain that markets can inflict.

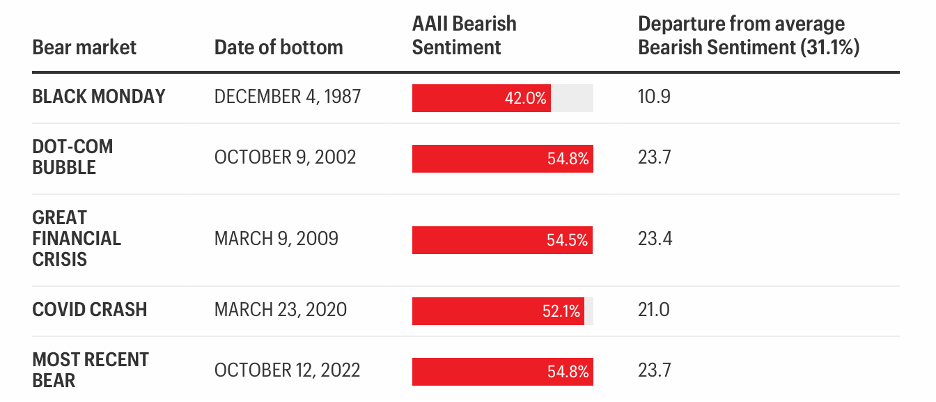

Fact: At the lows last October, the AAII Sentiment Survey showed bearishness had reached more extreme than during the depths of the pandemic or the global financial crisis. And it matched with the bottom of the awful bear market that followed the dotcom bust and lasted 2.5 years.

Get smart: Such pessimism is uncommon. We already priced in a lot of future fears so worrying is counterproductive.

At 31 percent, the AAII bullish sentiment is well below the stock market peaks in 1987 (when it reached 52 percent), 2000 (39 percent), 2007 (54 percent), and 2020 (41 percent).

Our advice? Hold on. Better times are around the corner.

Source: American Association of Individual Investors