Chamath Palihapitiya, founder and CEO of Social Capital, joined us to chat about what it means to play an infinite game, anchored on a just cause, a learning mindset, with intellectual flexibility, and the ability to truly invest long-term.

Here’s a pared-down version of our salon. You can watch the full conversation here.

On beginning the inward journey

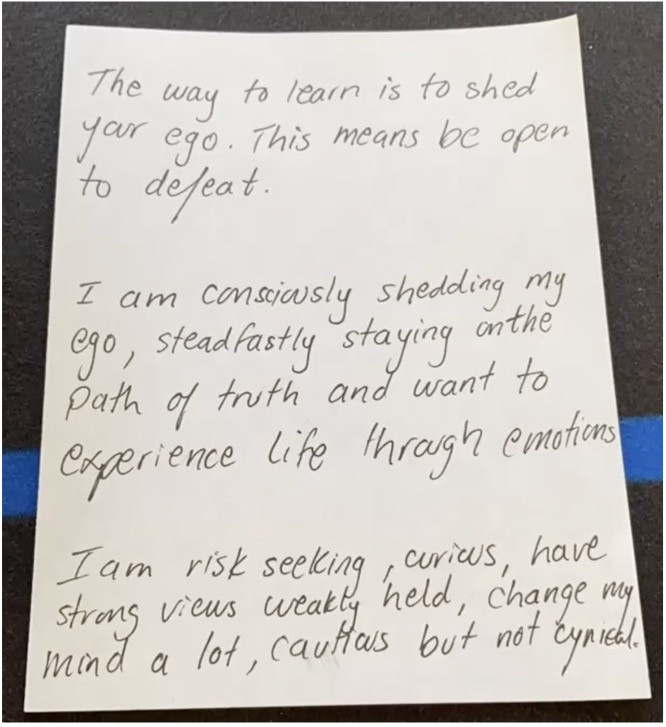

A year ago, Chamath texted me this hand-written note. What compelled him to write that?

“Those were moments where I started to see the bigger picture. There was a lot of work that I would have to do to be as good as I thought I could be and wanted to be in the things that I cared about.

“The realization was that there is an inner journey and an inner struggle to eliminate the things that a lot of us do which slows us down. It has taken me forty years to learn this: how to not be my own worst enemy and to prevent self-sabotage.

“In investing, it manifests in ways that are not so obvious. They’re extremely subtle, but they are deeply pernicious—how you manage risk, how you hold a position, how you double down, how you avoid bad decisions in moments of real volatility.

“These are all hard things that are impacted by one’s ego, which is meaningfully impacted by how one grew up. This handwritten note was a mnemonic way to remind myself daily that when I sit down at this desk, it’s time to get to work. This is the framework that I have to use to try to be better.”

On becoming aware of the ego

All of Buddhist knowledge is about dethroning the ego. But first, we must become aware of it. Chamath notes he became aware of the negative influences of the ego five or six years ago.

“If I had discovered it in my twenties, I would be a markedly different person. It takes decades to process one’s baggage and a lot of it happens very late in life.

“The good thing was, I had always been relatively open. My life has been well documented, so I could go back and see videos of myself, hear what I had said, and read what I had written. What I saw was an insecure person who was hurt, wasn’t necessarily doing a great job, but was trying to learn and throwing a lot of stuff out there.

“That’s when I put two and two together. If I’m going to be an incredible investor, a great entrepreneur, a great friend, or a great dad, then I must focus on myself. Ultimately, I have the responsibility of knowing who I am as a person so that I can approach others with the best of who I am, without bringing my own biases and judgments to them.

“Most human relationships are littered with that, and it slows a lot of people down from their best decisions. When it manifests at work, you can make some terrible decisions. You can also not make very important right decisions. If I wanted to have longevity and a continuous pattern of growth, then at some point I would have to first focus and be very selfish.

“I had to find what happiness meant for me, both in a personal and professional context, and then prioritize that at the sake of everything else.

“It is counterintuitive because culturally the word ‘selfish’ has a very negative connotation. But there’s nothing inherently bad about that idea, it’s just the focus on oneself. We don’t teach that in school; we don’t teach mental health; we don’t teach self-care.

“These are all things that highly elite people, if you're going to achieve extremely rare things, have to master. So, I said to myself, ‘Okay, I want to master this and see how good I can be without my own impediments getting in my own way.’”

On making good decisions

“It’s a very hard thing to do because these things are easier to see in hindsight. When you are being selfish it is important to not beat yourself up too much.

“I look at some of the bad decisions I’ve made in business. I start with this framework of let me be curious and learn; let me step back into my mind at that moment when I made that decision. Why did I make that decision? What was I feeling? What was I thinking? What was the market telling me? What was I telling myself? What were others telling me?

“There's a pattern of these questions that I go through, trying to isolate how pure I was to my own self in the decision making, or how polluted it was from outside perspectives that were not necessarily anchored in their own truth and happiness.

“It is a very arduous process because it is a lonely process. Nobody particularly cares. People find it self-indulgent if you talk about it too much. So, you need to do a lot of that work by yourself.

“But if you get up the other side, and you can unpack good decisions from bad decisions, you will start to see systematic patterns. What was I doing leading up to that decision? How was I learning? What was I thinking about? You will see that there’s consistency in good decision making.

“I try to center myself when I am making big decisions, so that I am always starting from these simple building blocks. This means eating simply and cleanly, exercising in a very specific way, reading very specific things, ignoring a lot of social media, ignoring the stock market, and talking to key individuals so that I can understand the fundamental truth.

“This process of first centering myself and then being a little repetitive, at the sake of driving my team crazy at times, allows us to arrive at good decisions. I think that has borne out, and that gives me tremendous confidence. So, I see myself getting more disciplined about this process.

“Otherwise, I am in a momentum game with everybody else, which is a very finite and dangerous game. Some people can play it very well; I can’t because it doesn’t suit my strengths and it amplifies my insecurities.”

On learning humility

“When I was twenty, I did not know what humility was because I put it in the category of humiliation. I was a precocious electrical engineering grad who had a job trading interest rate derivatives. I was good, but I was arrogant.

“My first year my boss did not give me a bonus. It was humiliating at the time because I had such a low self-worth. Then I realized it was about teaching me humility, which is self-confidence combined with some amount of peace and discipline. It is about taking what seems finite and making it infinite. That was my first encounter of someone teaching me humility, how to be gracious, and how to learn from a very stinging loss.

“One of the key traits that I learned about myself as a trader in that moment was that I could take swings in my P&L and I was largely the same. I was not emotionally rattled. People who really transcend and keep doing well over many decades as a capital allocator can take losses and step aside.

“But I didn’t have humility; I would vacillate between arrogance and humiliation. I would be over the top bombastic, or I would beat myself up and say I’m worth less than zero. That’s a terrible combination for an investor.

“Then there’s all the decisions I’ve made that have been just really shitty. I can laugh about it because it doesn’t make me shitty. That took a long time because those two things were very coupled. There’s a never-ending number of ways of self-flagellation.

“But these are not scalable tools, they are very finite, zero-sum games that do not work if you are trying to become great at something.”

On the pursuit of happiness

“I lead with my happiness. I err on the side of wanting to be selfish, focusing on things that make me happy because I can then give my best to everybody around me. It takes a while because you don’t necessarily know what makes you happy at first. It is not a skill that one is taught, you have to experiment and try different things.

“What makes me happy is I like to question societal norms. I like to change societal expectations. I like to come up with elegant solutions to very complicated problems. This served me well as an engineer and a product manager and it serves me well as a businessperson today.

“I like being myself. I don’t have the pressure to be somebody else. I want to celebrate that happiness and not feel guilty about it. All of this directs me into areas that I am fascinated with such as healthcare, biotech, financial risk management, AI, batteries, and climate change. My capital allows me to go and explore, learn, and push the boundaries of what is expected and see what comes up.

“Something that I've wanted to do for a long time is to build a distributed energy company and force the bottoms up deregulation of American energy. That's a big idea, and I get tremendous energy from that. It will question some societal norms and reframe societal expectations. It is an elegant solution to an extremely complicated problem. So, it makes me happy.”

On playing the infinite game

“The way that I manage risk has changed materially. I try as often as I can to think about multi-decade holding periods for the things that we own. In the moment, it is hard, but then you figure out guardrails to stay in an infinite mindset. If I’m thinking over the course of my lifetime, then what happens in three or four months is utterly irrelevant if we have made the right decisions.

“A good guardrail that I have come up with is to not be as prolific on social media because it is a double-edged sword that can distract me with my strengths and weaknesses as I know them to be. Another example is that I try to not check stock prices daily. It was easier fifty years ago, it’s much harder now because there’s an app on your phone, and you can just click it and suddenly you see it red and green, whether you’re winning or losing.

“I can’t tell you I am so enlightened as to not need demarcations of progress. There is a part of me that really likes to look at the score because it gives me energy to keep going. I need to see that I am winning because it reinforces good behavior and helps to isolate bad behavior.

“I have tried to build all these checks and balances to remind myself that if I’m truly being an infinite player, I’m only competing with yesterday’s version of myself, and none of these things matter. But it’s very hard.

“It’s like being a finely tuned athlete. If you look at somebody like Steph Curry, he’s the byproduct of tens of thousands of hours of practice. I feel investing is the same way. You can’t practice making investments for thousands of hours, but you can invest many hours in understanding yourself, getting into an infinite mindset, staying there, and then seeing the quality of those decisions versus just random decisions.

“I don’t think people slow things down enough to really try to do that. They want to boil things down to a spreadsheet, to a multiple, to a tweet, down to something that is not in their control. Things that happen over decades have nothing to do with cell AB47 in a spreadsheet, and people who don’t understand that get tricked into playing a finite game in an infinite market. You’re basically guaranteed to lose.”

On the cultural torrents reshaping society

Sometimes it’s more important to be a cultural observer than a markets observer. Chamath sees a broad societal arc of power shifting from insiders to outsiders.

“It was easier for a small group of insiders and a broad class of outsiders to live in a world where there was a massive information asymmetry. But societal pillar after societal pillar will get transformed because of social media as it amplifies the exaggerated nature of the distribution of assets. That will cause a massive leveling effect.

“It’s unacceptable now to know that the person beside you is a billionaire because he stumbled into bitcoin early. It angers people because they think, why not me? And it makes them insecure about their own capability. That’s the loop that a lot of people I think are in and social media exacerbates it.

“So, if you take it to its logical conclusion, industry after industry will have to ask itself, ‘How do we make things more symmetric so that folks are happier?’

“It’s not necessarily right or wrong, it’s just going to happen. You can see it in crypto, Defi, and stocks, but the financial markets in general will become more equitable. People are underestimating that we are going through a reallocation of capital. It is a more organized French Revolution.

“Money will first devolve to the edges, which is essentially what crypto allows you to do— to rewrite the rules and completely disrupt centralized origination and replace it with whatever you want. That’s going to devolve power to all kinds of institutions in different ways. The implication at scale is that it’s going to upend how capitalism works. Even if at the end of the day, it kind of tastes somewhat similar, it at least has a new label.”

On the bull case for Facebook

“That they build a metaverse; that there is no deemed monopolistic pricing power in their advertising platform; that people rely on it for enough utility where you cannot legislate them away; that the technology itself has been thoughtfully integrated together in enough of a technically complicated soup, that even if there was an edict to break the company apart, it would take another ten years. That would be the bull case.

“The bear case is more that behaviors change. Every successive cohort of young people wants to have their own thing that is different from the generation before them. I would not bet against Facebook because Mark is one of the smartest individuals I’ve ever met and is very competitive.”

On the myth of the metaverse

“I do not think there is enough clarity on what it is. If you think about important cultural moments that create huge swings of economic activity, they are taking complicated ideas and distilling them into an extremely simple intention.

“The first iteration of Facebook was extremely unsophisticated. Take all of the complexity of the global financial markets, the first version of a disruptive, society changing thing was a digital coin called Bitcoin. When there are definitional things that people can breathe thousands of different intentions into like the metaverse, it tends to take a little bit of time to sort it out.

“And it needs to map to how people want to live their life. I have not seen enough examples where I believe in the idea. I think it will work for a cohort of people, but I do not see a Ready Player One kind of world.”

On the coming biotech revolution

“There has been a merger of computer science and biology that is not well understood yet. There are these building blocks that are now emerging to bring biology into the realm of computer science. I see biology sort of like the 1960s where we are about to build the first real computer, which will allow us to build DOS, which will allow us to build Windows, which will allow us to see the real vision of the Internet. Instead of taking fifty years, I think it will happen in ten. We will cycle through a lot of these iterations much faster than people think.

“We are building very specific examples of gene editing and solving diseases. That’s an important shift from where we were because CRISPR as an idea, and as a platform, has been around for a while. However, we have never really been able to commercialize something that meaningfully changes how the world can work. Now we're learning how to program RNA and to cure disease. We’re able to construct solutions to biological problems in the same way I was taught to construct solutions to electrical engineering problems.

“I think cancer is an antiquated problem. We are going to learn there are extremely elegant solutions that can work for broad based forms of cancer. We have made some big improvements there recently, but it is not enough. In the next five or ten years, we will make meaningful progress against that.

“We are going to learn a lot more about the brain and how humans can be intellectually performative as we age. If you think about your IQ peaking at some point and then decaying as you get older, and then being able to add back that loss with the help of technical solutions. This reframes Alzheimer’s, dementia, and other neuro-degenerative diseases in a very different context.”

On why space is important

“We owe an enormous amount of gratitude to the Apollo project. If you go back to the 1960s and break down exactly what they needed to build, then you follow the trail of breadcrumbs, everything from clocks, memory, storage, gate arrays, which are the building blocks of computers, had to be fashioned for space.

“What people misunderstand about space is that it’s almost like a testbed. It allows us to fund a kind of R&D that would otherwise not get funded, which then allows us to commercialize and build things for Earth. We have proven that with the Apollo project, but then we lost our way.

“The R&D budgets of FAANG are multiples of the Apollo project, but we have nothing to show for it. What people should understand is going to space allows us to build a set of technologies that have enormous applicability on earth.”

On the biggest risk to the equity market

Chamath believes carbon tariffs are the biggest risk for equity markets over the next decade.

“Everybody that’s playing a finite game has a model. In there is an assumption about taxation and after-tax cash flows. There is a sense of what something is worth today.

“When you look at what’s happening in society, the writing is on the wall: we are trying to constrain corporations’ abilities to further pollute the earth without being accountable. We are seeing the emergence of carbon markets in many countries around the world. We are seeing more sophisticated carbon legislation.

“Imagine Germany says, ‘Anybody that wants to sell a car inside of my border will have to pay a tax related to the amount of total carbon emissions that were used to generate this good.’ That will rerate capital markets and break every DCF model. Nobody will know what the actual future value is worth at that point. A lot of volatility will happen in that moment.

On America’s “incredible” balance sheet

“We have an infinite balance sheet. We have no shortage of money, and I don’t think that’s well understood. People cannot easily accept that idea because it seems extremely disruptive, or that it’s meant to be provocative.

“We got very comfortable turning on the money printer. We love the idea of being able to manufacture money out of thin air. I think you’re going to see profligate forms of spending like you’ve never seen before. It will shock us all, but it will happen.

“And so, I think America is an incredibly good place because they are one of the few countries that can infinitely print money. The biggest thing China left undone was not further undermining the US dollar as a reserve currency. They could have done more damage had they been more patient.”

On the cost of success

“I think I have screwed it up for my kids. It’s much simpler to be born to somebody who did not accomplish anything. I had a great education system and mentors, but I was not born into money where I could be introduced to somebody at the golf club who could get me a job. I had none of that and I am proud of that. I am very sensitive to the fact that it will rob my children of that same gift, which is no expectations, so that they can focus on their own journey. I cannot give them that and it’s a bummer.”

On the parenting challenge

“It is important for me to raise curious, questioning, thoughtful, and kind people. Every parent has the task of taking the time to see their kids, and most don’t. To make it about them, you first must know yourself so that you know it’s not about you.

“Think of the parents always shuttling their kids to soccer, basketball, flute lessons. They’re living out their own biases, insecurities, and judgments, but never ask the kid or try to intuit what they value. I must learn how to reframe expectations so that they can have their own journey that fulfills them.”