Our dinner in Dubai, amidst a backdrop of opulence and grandeur, served as a catalyst for the community to converge and unravel the intricacies of the ever-evolving world around us.

As is customary at our events, each attendee submitted a chart to discuss with the group. Please find a summary of the charts and discussion below.

Chart 1: Short Flunkies Bullshit jobs are everywhere—jobs so completely pointless or unnecessary that jobholders are obliged to pretend they’re not.

Chart 2: Long Imbroglio “The euro is going to 1.50 against the US dollar.”

Chart 3: Short Morosis In the face of a historic challenge, Germany has proved to be more resilient than many had believed.

Chart 4: Long Chives China’s household bank deposits are $19.5 trillion, equal to 76 percent of US GDP. Once confidence returns, these savings could be significant fuel for the economy and the stock market.

Chart 5: Long Obscenity Copper is becoming less tied to cyclical construction cycles and more exposed to the secular growth of renewables, electric cars, data centers and grid capex.

Chart 6: Long Punks “Institutions are crowding retail investors out of gold while retail investors are crowding institutions into bitcoin.”

Chart 7: Short Sisyphus The West is shifting away from a culture of progress, and towards one of caution, worry and risk-aversion.

Chart 8: Long Triumph Before success comes in any man’s life, he is sure to meet with temporary defeat. The easiest and most logical thing to do is to quit. That is exactly what the majority of men do.

Short Flunkies

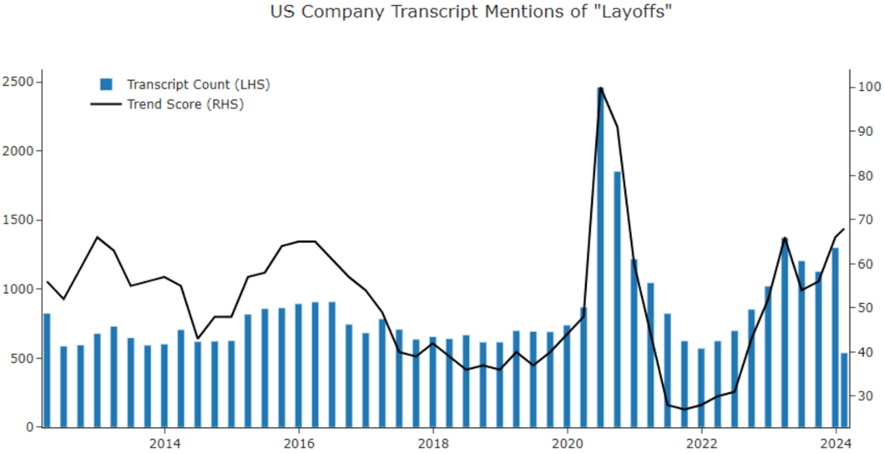

Source: Factset

In Bullshit Jobs, anthropologist David Graeber unveils five types of bullshit work.

Flunkies are paid to hang around and make their superiors feel important. Duct tapers temporarily fix problems that their bosses are too lazy or inept to fix permanently. Goons act to harm or deceive others on behalf of their employers. (Think lobbyists and aggressive salespeople.)

Box tickers go through various motions, often with paperwork or reports, to convey usefulness. Last are taskmasters whose job is to create and assign more bullshit to others. They manage people who don’t need management.

Thanks to a decade of cheap money and financial exuberance, bullshit jobs are everywhere—jobs so completely pointless or unnecessary that jobholders are obliged to pretend they’re not. Should they vanish, it would make no difference to anyone. And now with the advance of AI, CEOs are starting to realize that they can fire employees without any impact on the top-line.

Layoff announcements in February hit their highest level for the month since 2009, an increase of 3 percent from January and 9 percent from the same month a year ago, with technology and finance companies at the forefront. Other industries planning significant cuts include industrial goods manufacturing (up 1,754 percent from a year ago), energy (up 1,059 percent) and education (up 944 percent).

AI is significantly reshaping staffing needs. We’re witnessing a persistent wave of layoffs and hiring plans are the lowest on record.

IBM’s chief said the company plans to pause hiring for positions that could be replaced by AI, and UPS acknowledged that AI factored into its recent layoffs. Goldman Sachs estimates that AI could perform about one-fourth of the work done by humans today, but that two-thirds of jobs are exposed to some degree of AI automation.

“Why are the layoff numbers not feeding through to weekly jobless claims?” the speaker asks, puzzled. He is frustrated by the strength of the labor market, caught wrong-footed by the move higher in bond yields.

Unemployment has been under 4 percent since December 2021. The once high-flying quits rate continues to fall and is now below its pre-pandemic level, a sign that workers are feeling less confident about their prospects for finding a new job or more content in their current role.

More workers are still quitting than getting let go, however, and although the number of unfilled US jobs has fallen significantly from a peak in early 2022 it remains above pre-pandemic levels. There are about 1.4 open jobs for every unemployed person. This is a historically tight labor market and it will take longer than usual to unravel.

Long Imbroglio

Source: Various Sources

“The euro is going to 1.50 against the US dollar,” declares the speaker. Having captured everyone's attention, he proceeds to elaborate on the reasons.

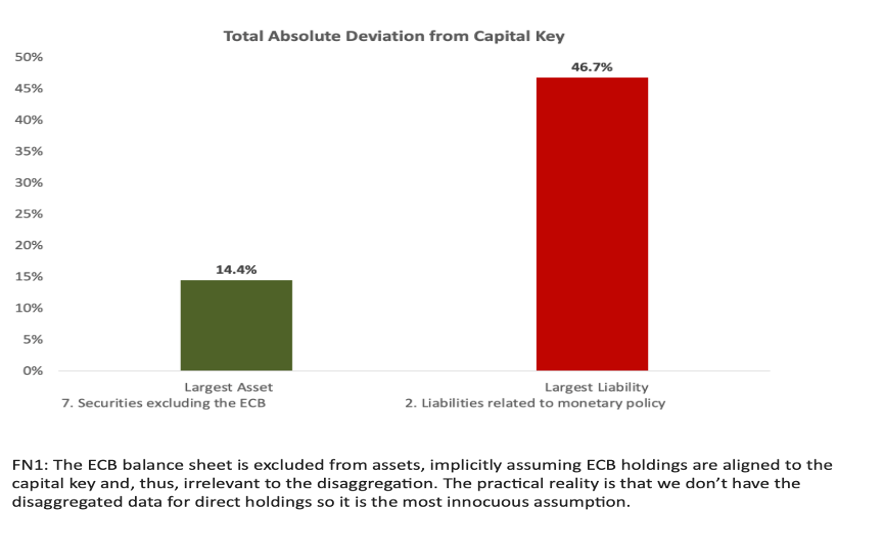

“I spent more time than I care to admit restudying the ECB disaggregate balance sheet. I wanted to create a chart that is easily replicated but something nobody has seen before as a foundation to an observation. This is the simplest illustration I could arrive at—only two numbers.

“I take the largest asset and largest liability on the ECB balance sheet—purchases of securities are mostly funded with the deposit facility. I take the distribution of those assets and liabilities across the twenty countries in the Euro area as a percentage of the total. The sum total is zero by construction of the monetary union. A euro is a euro is a euro independent of region. Regional surpluses have equal and opposite deficits.

But the distribution matters.

“One way of illustrating this point is taking the absolute difference of the regional central bank asset and liability relative to the capital key. This number

...