We travelled to Montreal for our final event of 2022. The warmth of the people more than made up for the frigid weather. There was love, laughter, and lots of wine.

As is customary at our dinners, each attendee was requested to bring a chart to discuss with the group. Please find a summary of the charts and discussion below.

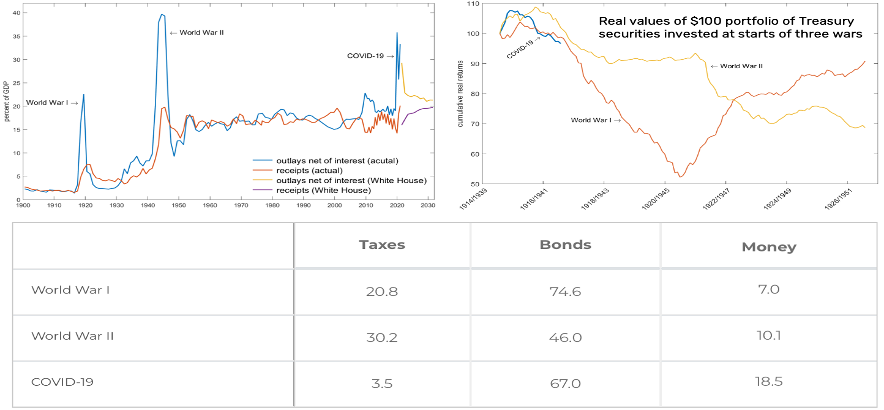

Chart 1: Short Keynes Bonds gave negative real returns in the twelve years after the starts of both world wars.

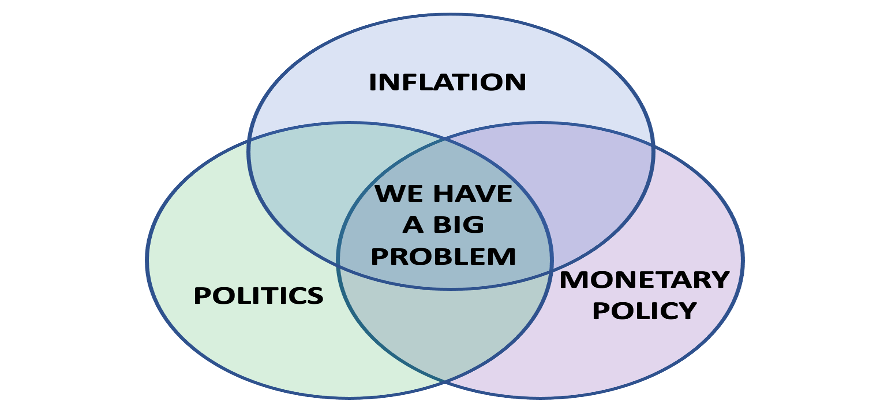

Chart 2: Short Enigma “Isn’t inflation actually a solution?”

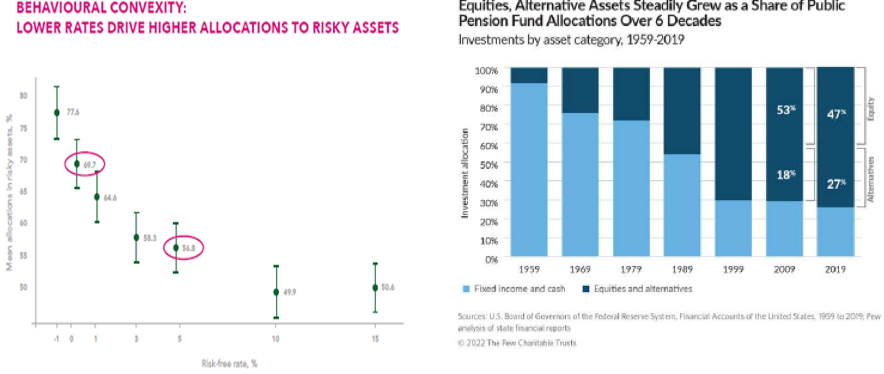

Chart 3: Long Imagination Increasing inflation volatility represents the greatest challenge to investors for a generation.

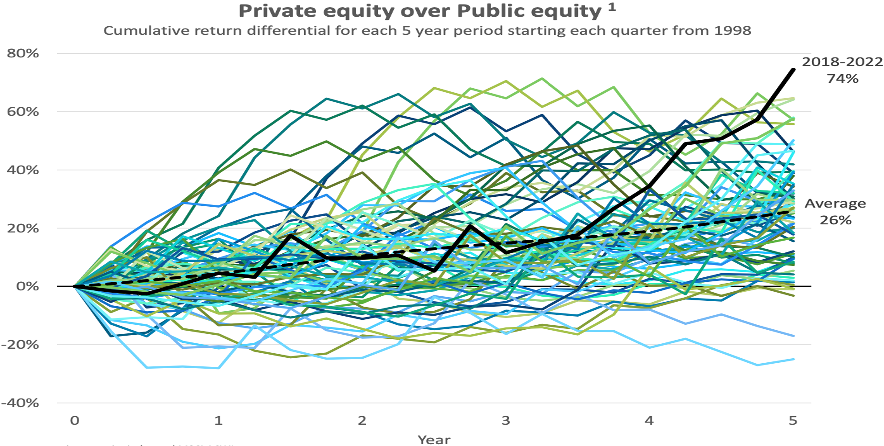

Chart 4: Short Alligators The widening performance gap between public and private markets is complicating the institutional asset allocation mix.

Chart 5: Short Greta “We are in year three of a ten-year commodity cycle.”

Chart 6: Long Gold Central banks have been building up their gold reserves this year at a pace not seen since 1967.

Chart 7: Long Oldies Population aging is the most pervasive and dominant global demographic trend.

Chart 8: Long Controversy An increasing lack of confidence in the media and the government has plunge the world into a vicious cycle of distrust.

Chart 9: Short Zombies Sleep is like shutting off the computer.

Chart 10: Long Spiderman The greatest gift you have to give is that of your own self-transformation.

Short Keynes

Source: “Three world wars: fiscal–monetary consequences” by George J. Hall and Thomas J. Sargent

“The two world wars and the fight against covid have a lot in common,” the speaker argued.

(1) Negative labor supply shocks from converting civilian workers to soldiers during the world wars; against older workers who left the labor force earlier than expected and a decline in immigration.

(2) Disruptions to domestic and international travel and trade.

(3) Permanent increases in federal expenditures as a share of GDP with an expanded Fed balance sheet.

(4) The price level rose dramatically during and after the two world wars (around 55 percent higher after ten years). Since February 2020, the price level has increased by 15 percent thus far.

Tax receipts funded 20.8 percent and 30.2 percent of World War I and World War II spending, respectively, versus only 3.5 percent of the pandemic response. “It is striking how little of the pandemic stimulus has been financed by explicit taxation compared to the two world wars,” said the speaker. He sees taxes going up.

After the two world wars, government spending declined (though it was still higher than pre-war levels) while tax revenues remained elevated, letting the government run a primary surplus for many years.

Compare that to the present: the CBO budget outlook report shows widening deficits over the next three decades as federal spending on healthcare and retirement benefits, climate change, and net interest payments will far outpace the modest increase in tax revenues.

“How should we think about the health and the sustainability of government borrowing?” asked the speaker. “This doesn’t strike me as particularly bullish for the dollar.”

Due to primary surpluses and real GDP growth, the US debt to GDP ratio fell from 28.6 to 20.2 percent between 1919 and 1928. The debt to GDP ratio fell from 90.1 to 35.7 percent between 1945 and 1960 for similar reasons but inflation was a significant factor once price controls were lifted in 1946.

After World War I, bondholders were looking at cumulative real losses of nearly 50 percent by 1920. After World War II, the Treasury’s portfolio was worth only 70 percent of its prewar value by 1951. Bonds gave negative real returns in the twelve years after the starts of both world wars.

As the speaker’s chart shows, the covid experience is closely matching the experience of the two world wars when you take the price level and cumulative real returns for bonds into account. He struck a somber note: “Future bond returns will be substantially negative in real terms.”

Short Enigma

Source: BIMCOR

“We have a big inflation problem,” said the speaker. “It’s more the uncertainty around the level than the actual level itself.” The future course of inflation is as hard to predict with certainty as the course of the conflict in Ukraine or the future path of the pandemic. This complicates decision making for consumers and businesses as well as central banks and policy makers.

While a decades-old macroeconomic regime is falling apart, trust in government and major institutions is near historic lows. The speaker sees a clash between tight-money central banks and politicians with a free-spending attitude. “The public mood is darkening,” he added, “and new political concerns will surface in the next twelve to eighteen months.”

Just think about what happened in the UK: Rishi Sunak is the country’s fifth prime minister in six years, and Chancellor of the Exchequer Jeremy Hunt is the fourth person to hold the position this year. All this turbulence at the top happened while the same party was in power.

An attendee pushed back, “Is inflation really a problem?” Consumer inflation expectations are declining again, with drops across all time horizons. He pointed to cooling inflation for housing, autos, and other long-lasting goods. There are some signs the labor market is softening as well, and wage growth is slowing. The employment cost index, a broad gauge of wages and benefits, has moderated since the first quarter.

“We are not in the early stages of a wage-price spiral that started in the late 1960s and early 1970s,” he said. “The current period of high inflation resembles the price spikes that occurred in the late 1940s after the end of the wartime mobilization.”

Following World War II, there was tremendous fiscal stimulus, large excess savings, a big labor market upheaval, and a major shift in what people were buying. After soaring for a year, inflation started to decline on its own.

“We are dealing with unexpected disruptions such as the pandemic and Russian’s invasion of Ukraine,” he continued, “but the world is finally normalizing, and inflation should settle at much lower levels.”

“Isn’t inflation actually a solution?” another participant offered.

Global debt increased from $83 trillion in 2000 to around $295 trillion in 2021—at nearly double the pace of world GDP growth. Global debt to GDP was 320 percent before massive government bailouts to pandemic-stricken economies propelled it to 355 percent.

“High inflation in many economies is helping erode debt burdens because of the sharply rising nominal value of gross domestic product,” he said. Global debt to GDP is about 15 percentage points below its peak last year. Although households in rich countries are highly indebted, the debt service costs they face are historically low.

Long Imagination

Source: Pew

The traditional investor mix of bonds and stocks (the 60-40 portfolio) has produced positive returns in 35 of 42 years from 1980 to the present. It has only had one negative year since 2008, which was in 2018 when it fell 3 percent. The portfolio generated returns of 22 percent, 14 percent, and 17 percent in 2019, 2020 and 2021, respectively.

The speaker refers to the 60-40 portfolio as the “most crowded trade.” It is down 15 percent this year, putting in the worst performance since 1932. “A new macro regime requires us to reimagine portfolios,” he said. In the words of Peter Drucker: “The greatest danger in times of turbulence is not the turbulence. It is to act with yesterday’s logic.”

Long-term treasuries are off 29 percent, performing even worse than the 24 percent decline in emerging market debt. The S&P 500 lost $11 trillion of value at its lowest point this year, about equal to the total yearly economic output of Canada, Germany, and Japan combined.

“Starting yields are the highest in years—in both nominal and real terms. Shouldn’t pension funds actually increase their allocations to bonds now?” an attendee asks. “At what level do you immunize to fund a future stream of pension benefit payments to retirees?”

A two-year Treasury now yields more than 4 percent. High-quality bonds issued by companies like Microsoft and Bank of America yield upward of 5 percent. Preferred stocks with fixed-interest payments offer 7 percent. Lower-rated bonds yield more with junk at about 9 percent. After suffering a big loss, the 60-40 portfolio has rebounded in nine out of the 10 following years with a median return of 17 percent.

“The future is reflexive, not mean reverting,” a participant warned. “In the past, even double-digit yields weren’t attractive because inflation was a top concern. That is the same today. Real returns matter.” Another participant agreed. “What if we get risk premium in sovereign debt?”

The speaker quoted one of his favorite investors, Ruffer CIO Henry Maxey: “Investing for inflation volatility is not the same as investing for inflation. Confusion in this respect will be costly to investors. Increasing inflation volatility represents the greatest challenge to investors for a generation.”

The argument being that a portfolio that is purely positioned for inflation runs the risk of losing money when inflation is declining. More abrupt economic cycles interacting with liquidity cycles and changing policy reaction functions requires portfolios to be more intricately constructed—more liquid and active.

The dilemma is that lower interest rates over the past decade drove higher pension allocations to longer-duration riskier and private assets, making portfolios less liquid.

Short Alligators

Source: State Street private equity index and MSCI All-Country World Index

The speaker’s chart demonstrates the astonishing historical relative outperformance of private equity against public equity. Is this sustainable? Several of the factors that have undermined the public markets are also worrisome for private equity. Is the performance of private assets being stated accurately? The low volatility of private equity: is it genuine or just a mirage? All of these questions are on the speaker’s mind.

Despite the fact that this is the one of the worst stocks and bond markets ever, many private equity and private debt funds are only reporting small losses. The widening performance gap between public and private markets is complicating the institutional asset allocation mix.

“We have a beautiful problem,” the speaker shared. “Our private equity allocation has grown from 12 percent to 20 percent as a result of the alpha generated. However, the performance gap this year has now sprung wide like an alligator’s jaw. We are overallocated by a huge margin.”

In order to manage the target fixed allocation to private equity, the speaker is now a net seller for the foreseeable future. “For every $1 I give to the PE team for a new deal, I want $1.2 back in proceeds from existing investments,” he said.

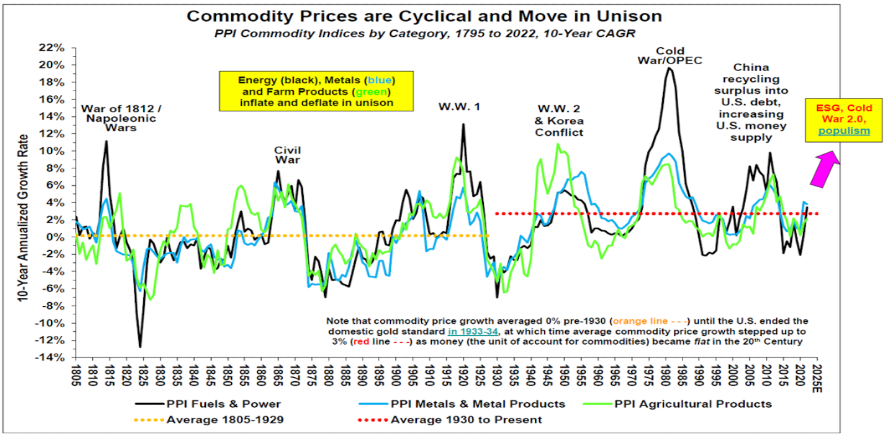

Short Greta

Source: Warren and Pearson Commodity Index, Stifel

The 10-year annualized growth rate of commodity prices indicates that a new secular commodities bull market is just getting started. “We are in year three of a ten-year cycle,” said the speaker. “Go long commodity miners and short tech.”

The Bloomberg commodity index is up 15 percent this year despite a stronger dollar. Miners are up 15 percent while energy stocks are up 56 percent. Nasdaq is down more than 30 percent. He called it the “pain trade” as most investors are either unwilling or unable to participate. An attendee acknowledged that it’s tough for pension funds to fight the ESG tide. He is not increasing the allocation for commodities.

The speaker continued: “What ESG fans fail to realize is that the global energy transition is resource intensive and going to lead to higher demand for many commodities like lithium, copper, aluminum, and steel.”

If the world wants to get to net zero, we require almost $100 billion in capex every year to make sure we don’t run out of critical raw materials. In actuality, BHP anticipates spending $7.6 billion in 2023 and $9 billion in 2024. Rio Tinto reduced this year’s capex from the expected $8 billion to $7.5 billion.

Miners are prioritizing spending their capital to make their existing asset base less carbon intensive (rather than investing in new greenfield projects) because they don’t want to pay the carbon tax.

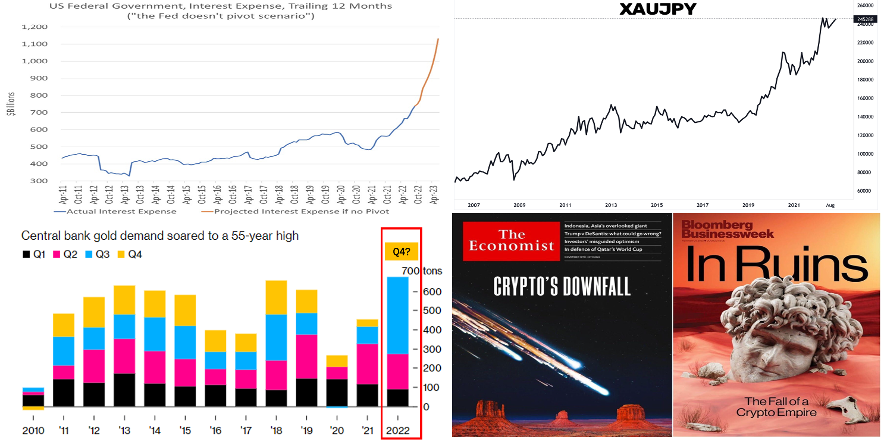

Long Gold

Source: World Gold Council, The Economist. Bloomberg

“Buy gold,” said the speaker, looking around the table. No one seemed excited by the idea. There were doubts about whether gold was truly a safe haven or an inflation hedge. “Gold’s performance should be much stronger considering multi-decade high inflation,” an attendee countered.

“People associate high inflation with a strong gold market, but what really matters is the trend in real interest rates,” the speaker explained. “Interest rates have increased at the fastest pace in forty years; the dollar index soared 19 percent at one point, yet gold is flat year-to-date. That’s impressive relative performance.”

Gold is still in a bull market in most currencies. It is up around 10 percent this year priced in euro or British pounds, while it is up 18 percent in yen terms, reaching an all-time high in 2022. According to the speaker, gold will now restart its upward trend versus the dollar.

The price of bitcoin plunged 70 percent in 2011, 83 percent in 2013, 84 percent in 2018, and 77 percent from its peak last year. “That’s not a safe asset,” the speaker added. The market value of all cryptocurrencies, which surged to nearly $3 trillion in 2021, has fallen to $840 billion.

Meanwhile, globally central banks have been building up their gold reserves this year at a pace not seen since 1967. Buying in the third quarter was at a record high, 28 percent more than a year ago. He reiterated his recommendation: “Buy gold.”

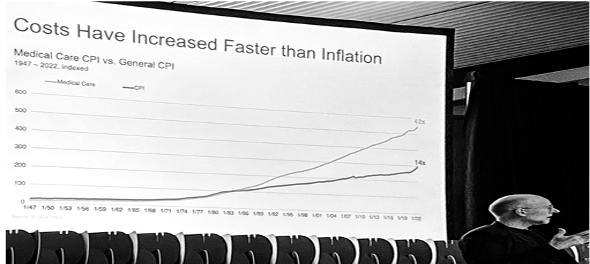

Long Oldies

Source: Scott Galloway

“Population aging is the most pervasive and dominant global demographic trend,” said the speaker. “It is undeniable.” While many focus on the colossal set of health, social, and economic challenges brought on by these shifts, the speaker sees opportunity.

Advances in health technology, such as the development of vaccines, wearable health monitoring sensors, assisted devices (robots), interoperable electronic medical records, are only going to accelerate with the use of big data and artificial intelligence.

The speaker is bullish on health tech, and he’s made a number of early-stage bets. “Health care spending has been increasing at a 9 percent yearly pace, three times faster than inflation,” he pointed out. “Ageing will lead to an even faster rate.”

“The endgame for an aging population is death,” the speaker continued. “I’m the owner of the largest funeral home in Quebec.” He’s also the owner of the largest botox injection company.

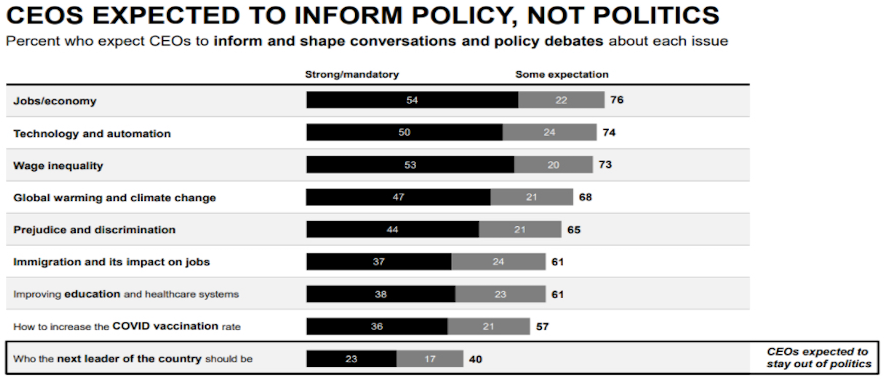

Long Controversy

Source: The 2022 Edelman Trust Barometer

An increasing lack of confidence in the media and the government has plunge the world into a vicious cycle of distrust. These two institutions are perpetuating the cycle of deception and division while also utilizing it for their own political and economic benefit.

The outcome, according to the 2022 Edelman Trust Barometer, is that more and more people perceive societal leadership as being a key duty of business. When considering a job, 60 percent of people expect the CEO to speak publicly about controversial social and political issues that they care about.

“Businesses are being pressured to take on societal problems beyond their abilities,” said the speaker. “CEOs are not prepared for it, particularly in today’s cancel culture. Boards are also unequipped. Profit maximization is no longer the exclusive goal.”

BlackRock CEO Larry Fink is a leading corporate voice in the ESG movement. Yet he gets criticized by Republicans like Florida governor Ron DeSantis for hurting the energy industry and fueling America’s “woke” culture, while Democrats like senator Elizabeth Warren have condemned him for not doing enough.

BlackRock has been accused of favoring its ESG commitments at the expense of pension fund profits and some states, including Louisiana and Florida, have pulled money from BlackRock funds.

The speaker also stressed the need for CEOs to inspire leadership in order to recruit people in the face of labor shortages. She cited David Solomon, the CEO of Goldman Sachs, as an example of someone out of touch who labelled remote work an “aberration.”

Solomon has repeatedly demanded that staff come back to the office. But on February 1, when Goldman reopened its New York headquarters, just half of the staff showed up. In-office attendance today is still only about 65 percent.

The speaker went on to say that CEOs “must restore belief in society’s ability to forge a brighter future to demonstrate that the system works for everyone.”

As some states passed abortion bans, dozens of businesses, including Amazon, Apple, Disney, Netflix, and Comcast, pledged that they will “cover travel for reproductive services unavailable locally.” However, it’s unclear how such a policy will work in practice, and whether companies will keep their word if legal challenges arise.

“It’s a mine field out there,” she concluded.

One of the attendees suggested that everyone read Non-Violent Communication by Marshall Rosenberg and The 15 Commitments of Conscious Leadership by Jim Dethmer and Diana Chapman. To live and work effectively today requires the knowledge found in these works.

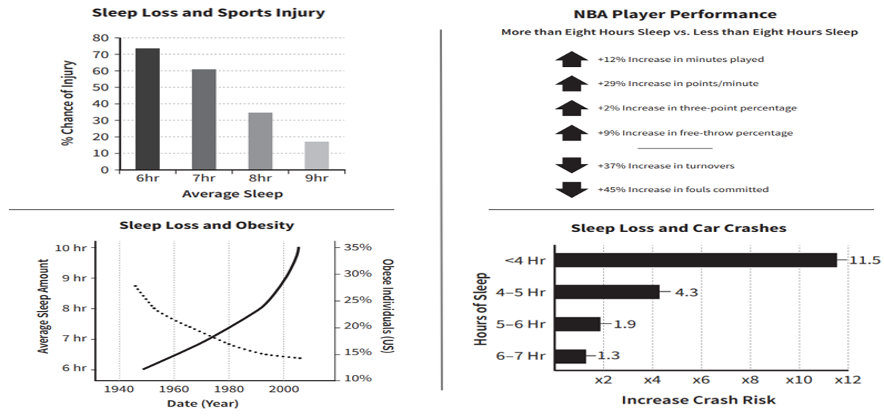

Short Zombies

Source: “Why We Sleep” by Matthew Walker

Coffee arrived just in time for our next topic: sleep. The speaker discussed insights from a book he recently read that altered his life: Why We Sleep by Matthew Walker.

Neglecting sleep, he learned, undercuts our creativity, problem solving, decision-making, learning, memory, hearth health, brain health, mental health, emotional well-being, immune system and even our life span.

“Markets don’t sleep, but because we work in a high-performing industry, I’ve come to realize that I must get proper sleep,” the speaker said. According to him, sleep is like shutting off the computer.

How much sleep should we get? And how can we ensure that it is restful sleep?

1. Aim for eight to ten hours of sleep. Anything less than seven hours impairs our alertness and working ability. And know that sleeping longer on another day won’t make up for a lack of sleep.

2. Go to bed and wake up at the same time every day, even after a bad night’s sleep or on the weekend. Be consistent so that your body’s circadian rhythm follows along.

3. An hour before bedtime, dim the lights, put down the phone, and turn off all screens. Eliminate as much blue light as possible to allow yourself to wind down and your brain to release melatonin.

4. Take a hot bath before bed and keep your bedroom temperature cool; about 65 degrees Fahrenheit for cooling your body towards sleep.

5. Avoid caffeine after 1pm and never go to bed tipsy. Alcohol is a sedative and sedation is not sleep. It also blocks your REM dream sleep, an important part of the sleep cycle.

The speaker glanced at the empty wine glasses and coffee cups on the table and remarked, “We’re all screwed tonight.”

Long Spiderman

Source: Reddit

The evening’s final chart was a picture of a retired-looking Spiderman addressing a crowd and a graph with the words “great power” and “great responsibility” on the two axes.

“With great power comes great responsibility,” the speaker said. “Each of us in this room holds a position of power, whether it is in our company, family, or society. What do you believe to be your responsibility?”

“I think a lot about the tragedy of horizons,” an attendee shared. “It refers to a mismatch between long-range problems like climate change and considerably shorter career spans that results in a discrepancy between short-term incentives and long-term goals. How can we fix that?”

One of the participants, who anticipates further economic and political turmoil, stated that it is his responsibility to “listen more” in order to have a deeper understanding. “We naturally try to respond to problems by trying to fix them,” he said, “but listening is just as important and often neglected.”

“My responsibility is to leave things better than I found it,” shared a participant. In his capacity as CIO, he seeks to strengthen the organization and improve performance of individuals and teams by leveraging cross-training and passing on knowledge.

This was a common theme: building up people. “While our small shop is a drop in the ocean,” a participant said, “I want to train and coach junior analysts.” Another stated that he sought to boost others’ “self-esteem” and to acknowledge their small victories.

“There should be a third axis,” mused an attendee. “Ego. That strikes me as a major problem as our power grows. The ego line ought to remain flat or maybe going downward. That’s not easy.”

According to one of the participants there should only be one axis: responsibility. “I’m only concerned with what I can do. I don’t need to have power,” he said. “People in positions of great authority frequently have blind spots and commit grave errors.”

A CIO stated that his responsibility is reading, reflecting, and impacting others. He writes a daily email with useful links that he shares with his peers. His company’s motto is to “give meaning to your time investment.”

The only women in the room shared that family is her number one responsibility. As CEO of a business supported by a pension fund, she also feels honored and a tremendous sense of duty to the 8 million Quebecois. “Good is not good enough,” she said, “I want to encourage and make people great.”

One of the attendees said that he had a “soft spot” for the underprivileged. He arrived in Canada thirty years ago with little and is now the founder and CIO of his own asset management company. He loves supporting people with passion.

The last speaker shared a passage from Lao Tzu.

If you want to awaken all of humanity, then awaken all of yourself. If you want to eliminate the suffering in the world, then eliminate all that is dark and negative in yourself. Truly, the greatest gift you have to give is that of your own self-transformation.

“That’s my responsibility,” he said. “My own self-transformation.”