The defining feature of 2019 was weakening global activity, with consensus growth forecasts being repeatedly downgraded. This was driven by the drop in fixed investment linked to trade policy uncertainty, the large reductions in inventories in the advanced economies in the second half of 2019, the decline in IT production in Asia, the struggles of the German auto industry, and the drop in infrastructure spending caused by the tightening of credit policy in China. The encouraging news is that the recession in the global manufacturing sector may now be ending.

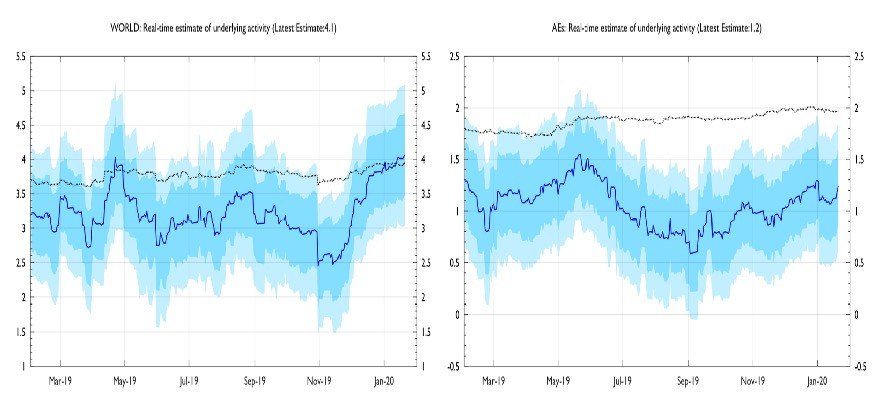

The Speaker’s nowcast models—designed to assess activity in exactly this type of uncertain situation—indicate that global real activity growth is running at a buoyant 4.1 percent, about 1.6 percentage points higher than three months ago. Activity appears to have bottomed out in the Asian economies, including China. Recession risks are deemed to be low at about 5 percent for the US and 15 percent for the eurozone.

However, the Speaker disagrees with the growing consensus opinion that another reflationary cycle is taking hold. He sees evidence of growth dispersion with Germany not seeing a notable growth uptick despite data recovering in China. This could just be due to a lagged effect but then the traditional reflation indicators like oil, copper, and Australian dollar are also weak. The result is that he is not comfortable being positioned on the long side of the market or taking aggressive risk at this point.

Source: Fulcrum Asset Management

One of the participants said that the US PMI could get back to the 52-53 range from 47 in December, but that is all. The uncertainty related to the presidential election and the outbreak of the coronavirus will make for a more challenging economic environment. The “phase one” trade deal still leaves the US imposing between 7.5 to 25 percent tariffs on $370 billion of Chinese imports. What makes him nervous is the confidence with which Bridgewater’s co-CIO Bob Prince said that, “The boom-bust cycle is over” at Davos.

It was discussed whether the coronavirus would lead Beijing to unleash another round of massive stimulus. While some argued that should be the case as there are no political or policy constraints, others were less certain of this outcome as China’s credit efficiency is weakening and it would reverse the gains from financial deleveraging over the past couple of years. “As long as there are no severe job losses, there won’t be much pressure to stimulate aggressively,” one participant said. The economic impact is still hard to quantify at this point.

Everyone agreed this will be a very challenging year to navigate markets.

Photo: Pexels