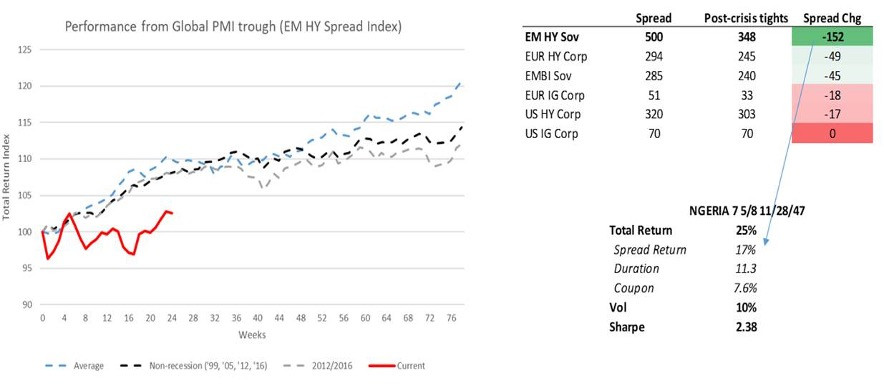

Looking at the chart, the performance of emerging markets (EM) high yield credit following a trough in the global PMI, the Speaker said that the rally in EM assets is modest by historical standards. He expects the global policy pivot and the stabilization in PMIs to drive risk-on appetite. High yield EM sovereign credit should deliver double digit returns this year as it plays catch up.”

Current spreads sit well of the post-2008 crisis tights while other segments of credit are almost there already. He recommends loading up on duration (30+ year paper) to get the most “bang for your back.” He likes the credit profile of Nigeria, Egypt, and Ghana. “Even if spreads don’t tighten, you get a 7 percent return.” The aggregate EM external position generally points to less vulnerability.

Source: Bloomberg

Photo: Pexels