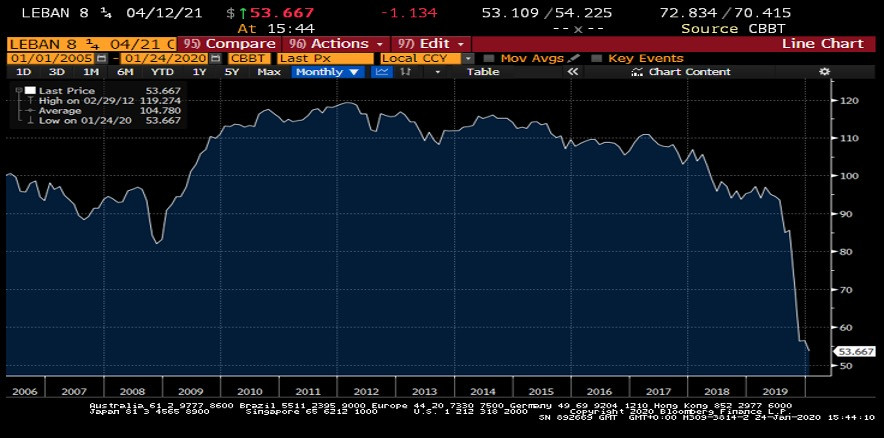

The Speaker is a distressed credit investor and noted that the market is getting “fed up” with countries looking to roll over their existing liabilities without making any structural improvements in the macro fundamentals. He pointed to Lebanon as a case in point which has experienced a bond market meltdown. “It’s a cliffhanger for countries... The crisis comes slowly, slowly, slowly, then all at once.”

Unlike the previous Speaker, he actually thinks that sub-Saharan Africa is most at risk. “Zambia at 7 percent does make any sense.” And he is only a buyer of Lebanon 21 bonds near 30 cents on the dollar. Another participant argued that vulnerable EM countries will need to fend for themselves. The choice is either a currency devaluation or default.

Source: Bloomberg

Photo: Pexels